Read more information on the details of our price cap for high-cost short-term credit loans.

In December 2013, Parliament gave us a duty to introduce a price cap to protect consumers from excessive charges from high-cost short-term credit (HCSTC). The harm included rates that were then as high as 4% per day with a typical customer taking out 6 loans per year.

Our remedies: A price cap, risk warnings and restrictions

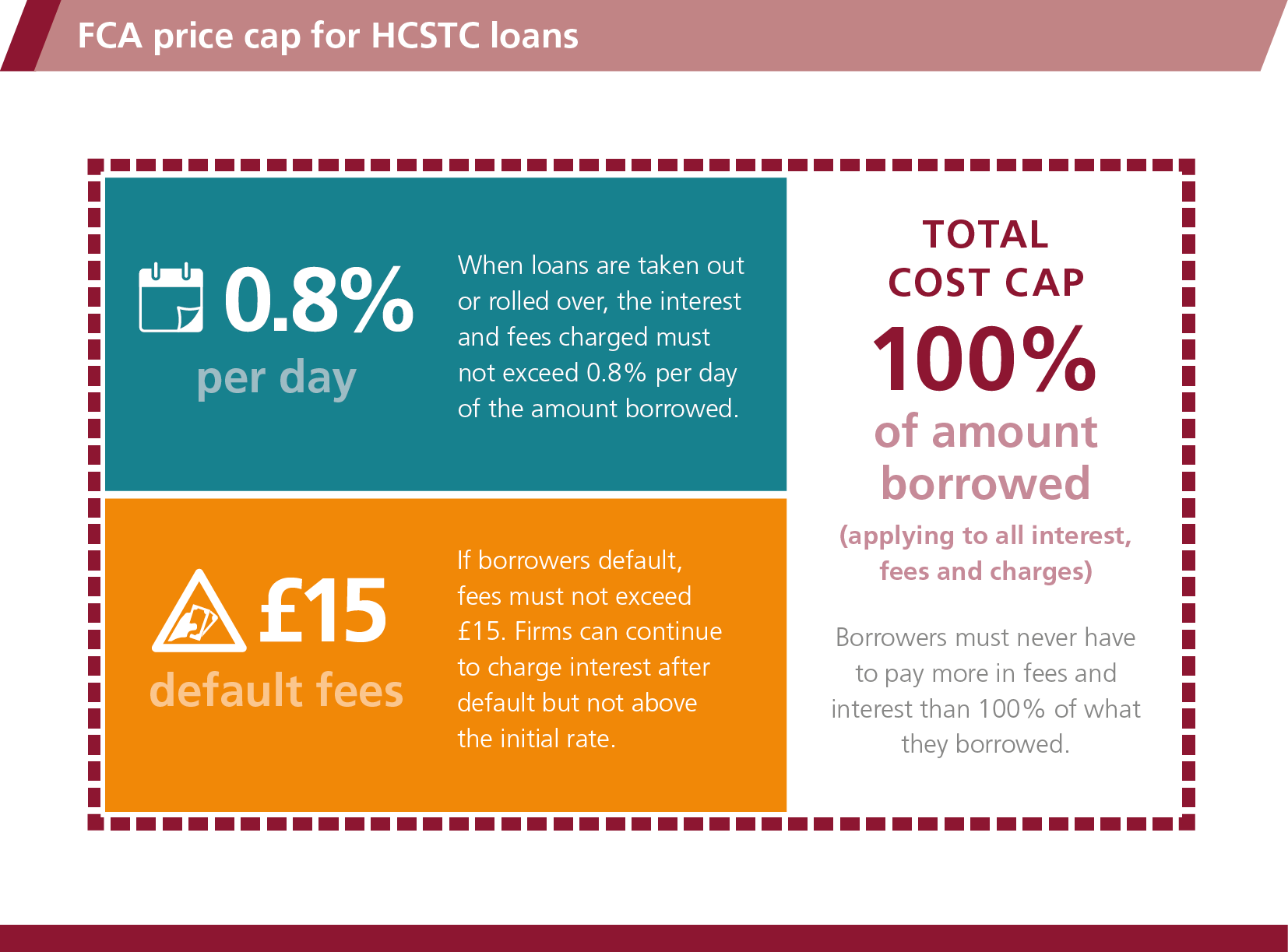

We introduced a price cap[1] with effect from 2 January 2015. This followed the introduction of risk warnings to consumers and restrictions on rollovers and how recurring payments are collected.

View full sized image (PDF)[2]

The impact of our changes

We reviewed our HCSTC rules[3] in 2017. We found that the 760,000 borrowers in this market have saved around £150m per year. Our reforms have led to cheaper loans, better affordability assessments, and fewer customers experiencing debt problems with payday loans. We maintained the cap at the current level and will conduct another review in the second half of 2020.