People using payday lenders and other providers of high-cost short-term credit will see the cost of borrowing fall and will never have to pay back more than double what they originally borrowed, the Financial Conduct Authority (FCA) confirmed today.

Martin Wheatley, the FCA's chief executive officer, said:

'I am confident that the new rules strike the right balance for firms and consumers. If the price cap was any lower, then we risk not having a viable market, any higher and there would not be adequate protection for borrowers.

'For people who struggle to repay, we believe the new rules will put an end to spiralling payday debts. For most of the borrowers who do pay back their loans on time, the cap on fees and charges represents substantial protections.'

The FCA published its proposals for a payday loan price cap in July. The price cap structure and levels remain unchanged following the consultation. These are:

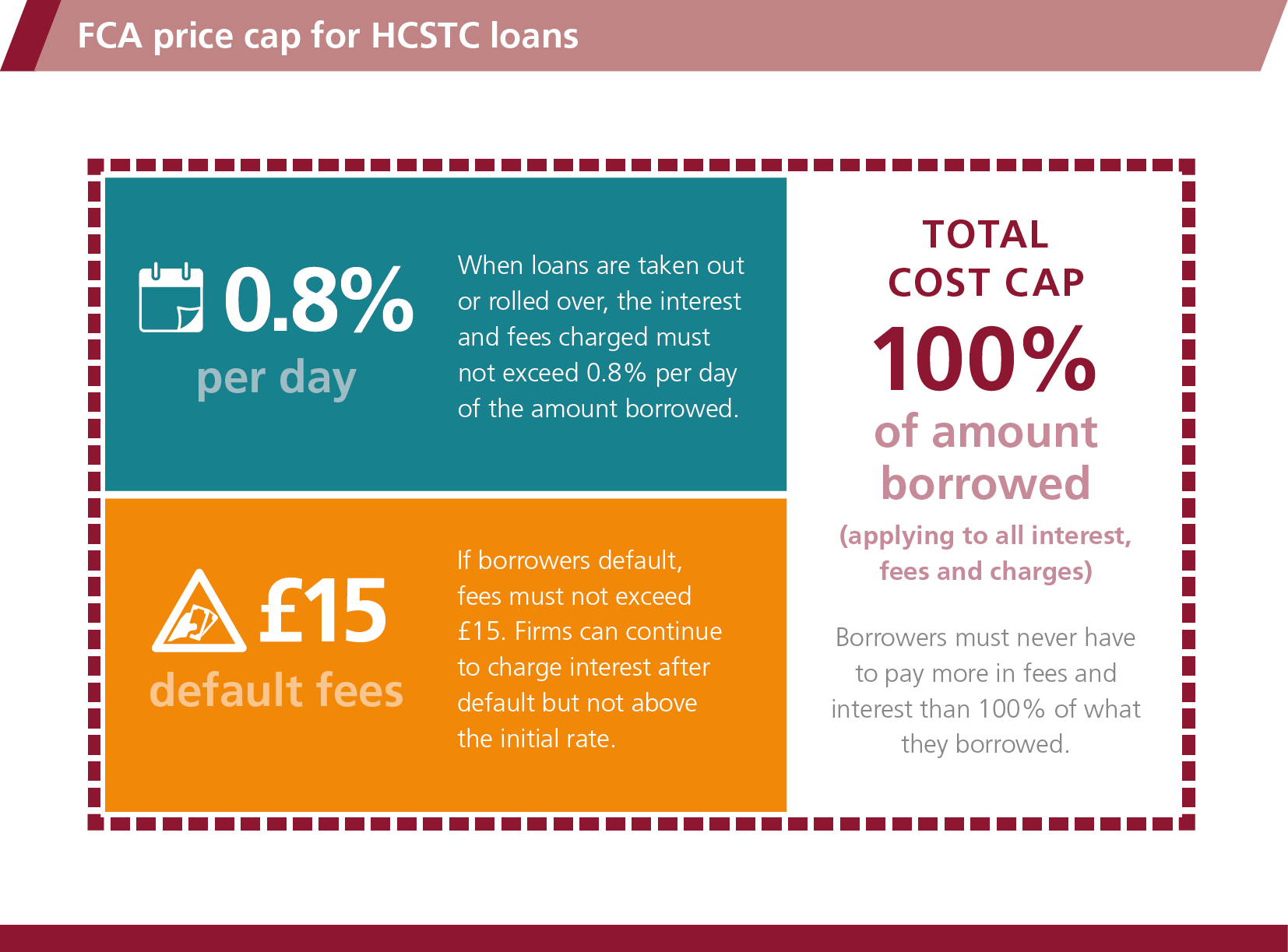

- Initial cost cap of 0.8% per day - Lowers the cost for most borrowers. For all high-cost short-term credit loans, interest and fees must not exceed 0.8% per day of the amount borrowed.

- Fixed default fees capped at £15 - Protects borrowers struggling to repay. If borrowers do not repay their loans on time, default charges must not exceed £15. Interest on unpaid balances and default charges must not exceed the initial rate.

- Total cost cap of 100% - Protects borrowers from escalating debts. Borrowers must never have to pay back more in fees and interest than the amount borrowed.

From 2 January 2015, no borrower will ever pay back more than twice what they borrowed, and someone taking out a loan for 30 days and repaying on time will not pay more than £24 in fees and charges per £100 borrowed.

Price cap consultation, further analysis

The FCA consulted widely on the proposed price cap with various stakeholders, including industry and consumer groups, professional bodies and academics.

In July, the FCA estimated that the effect of the price cap would be that 11% of current borrowers would no longer have access to payday loans after 2 January 2015.

In the first five months of FCA regulation of consumer credit, the number of loans and the amount borrowed has dropped by 35%. To take account of this, FCA has collected additional information from firms and revised its estimates of the impact on market exit and loss of access to credit. We now estimate 7 % of current borrowers may not have access to payday loans - some 70,000 people. These are people who are likely to have been in a worse situation if they had been granted a loan. So the price cap protects them.

In the July consultation paper[1] the FCA said it expected to see more than 90% of firms participating in real-time data sharing. Recent progress means that participation in real-time data sharing is in line with our expectations. Therefore the FCA is not proposing to consult on rules about this at this time. The progress made will be kept under review.

The final policy statement and rules[2]. The price cap will be reviewed in 2017.

Notes to editors

- Price cap on high-cost short-term credit: Policy Statement 14/16[2]

Proposals consulted on: position unchanged

The cap will have three components: an initial cost cap; a cap on default fees and interest; and a total cost cap.

[3]

[3]

View full sized image PDF[4]

Initial cost cap

- The initial cost cap will be set at 0.8% of the outstanding principal per day, on all interest and fees charged during the loan and when refinancing.

- Firms can structure their charges under this cap in any way they choose, for example, a portion could be upfront or rollover fees.

- Default cap

- The cap on default charges will be £15.

- Interest can continue to be charged but at no higher rate than the initial cost cap (calculated per day on the outstanding principal and fixed default charges).

Total cost cap

- The total cost cap will be 100% of the total amount borrowed, applying to all interest, fees and charges.

Application of the cap

- It will apply to high-cost short-term credit (HCSTC) as defined in our current CONC rules.

- The cap will cover debt collection, debt administration and other ancillary charges; and charges for credit broking for a firm in the same group or where the broker shares revenue with the lender.

Repeat borrowing

-

- The price cap will apply to each loan agreement, and so to repeat borrowing in the same way as for a first loan.

Data sharing

- Firms engaging in this market should be participating in real-time data sharing, so that the vast majority of loans are reported in real-time.

- Recent progress is in line with our expectations. This will be kept under review.

Supervision

- Our supervisory approach will follow our standard model.

E-Commerce Directive (ECD)

- UK-based debt collectors will be prevented from collecting debts arising under HCSTC agreements entered into by incoming ECD lenders whose charges exceed the price cap.

- UK-based debt administrators will not be able to enforce or exercise rights on behalf of a lender under such HCSTC agreements.

- The Treasury has already announced its intention to lay before Parliament, ahead of the cap coming into effect on 2 January, an Order to confer a power on the FCA allowing us to take action if an incoming firm abuses the EU right of free movement by establishing in another member state directing all or most of its activities into the UK, with a view to avoiding rules that would apply if it had been established in another member state.

Review period

- There will be a review of the price cap in the first half of 2017.

Proposals consulted on: changes and clarifications made

Application of the cap to loans made before January 2015

- We have adjusted the rules so that if an HCSTC agreement is modified after 2 January 2015, charges imposed before 2 January must be taken together with charges imposed after that date for the calculation of the cap.

Calculation of the cap

- We have amended the rules to cover calculation of the cap when loans are refinanced.

Unenforceability

- We have clarified that when an agreement is unenforceable, consumers still have a statutory duty to repay the principal, once a firm has repaid the interest or charges to the consumer, or indicated that there are no charges to repay. Customers must repay within a reasonable period. Lenders cannot make a demand in less than 30 days. We give guidance on what is reasonable in different circumstances.

Repeat borrowing

- We will do further work to assess the impact of repeat borrowing and whether firms are adequately assessing affordability.

- The FCA’s final rules for all credit firms including payday lenders were published in February 2014[4].

- The Money Advice Service is publishing new advice to help consumers who are considering taking out payday loans.[5]

- Firms must be authorised by the FCA, or have interim permission, to carry out consumer credit activities. Firms with interim permission need to apply for authorisation in an allocated application period which last for three months and run from 1 October 2014 to 31 March 2016.

- The FCA took over responsibility for the regulation of 50,000 consumer credit[6] firms from the Office of Fair Trading on 1 April 2014.

- The Financial Services and Markets Act 2000 gives the FCA powers to investigate and prosecute insider dealing, defined by The Criminal Justice Act 1993.

- On the 1 April 2013 the Financial Conduct Authority (FCA) became responsible for the conduct supervision of all regulated financial firms and the prudential supervision of those not supervised by the Prudential Regulation Authority (PRA).

- Find out more information about the FCA.