Find out what standards we expect from international firms providing financial services in the UK, or preparing to apply for full UK authorisation.

1. Introduction

For international firms to operate in the UK in a way that protects consumers and market integrity, we want to make sure they:

- understand how to satisfy the relevant minimum standards when applying for authorisation

- continue to meet the standards once authorised

- are aware of our approach

This document sets out our general approach to international firms providing or seeking to provide financial services that require authorisation in the UK.

We are not changing existing rules or other provisions in the FCA Handbook[1].

This guide covers:

- how we will assess international firms against minimum standards when they apply for authorisation and during ongoing supervision by us

- our general expectations for international firms

- circumstances when international firms could present higher risks of harm

- how those risks can be mitigated

This document supplements existing policy statements and guidance, as well as our Handbook.

1.1. Who this approach applies to

This document is relevant for international firms that:

- require authorisation in the UK, including those that have applied or intend to apply in the future

- are already authorised in the UK

This document is intended to help international firms understand our expectations as they prepare for their applications for full UK authorisation. This could help inform firms' decision about how they might want to structure their businesses to provide regulated financial services in the UK.

This approach document is not relevant for firms that do not require authorisation to operate in the UK. This includes, for example, persons relying on the Overseas Persons Exclusion at article 72 of the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001.

Subject to what we say in the section headed 'The focus of this approach' below, this approach document does not apply to entities that may require authorisation or registration but must be incorporated in the UK. This includes, for example:

| Entity type not covered by this approach | Notes |

|---|---|

| Firms required to be authorised or registered under the Payment Services Regulations 2017 | Must be incorporated in the UK. |

| Firms required to be authorised or registered under E-Money Regulations 2011 and have their registered office in the UK | This relates to firms that provide payment services that are unrelated to money issuance. |

| Depositaries, trustees and managers (also referred to as operators) of UK authorised funds (including UK Undertakings for Collective Investment in transferable Securities Directive (UCITS) schemes) |

The relevant legislation requires such entities to be incorporated in the UK, and for their affairs to be administered in the UK. |

| International alternative investment fund (AIF) managers | Only firms with their registered office in the UK can get permission to manage an AIF. |

| International benchmark administrators | The relevant legislation does not allow non-UK entities to get permission for benchmark administration (but there is a separate regime under which they can apply to be recognised). |

Regulated activities under FSMA 2000

Most firms applying for FCA authorisation will be seeking permissions under Part 4A of the Financial Services and Markets Act 2000 (FSMA).

The relevant minimum standards these firms must meet are called threshold conditions. These are set out in:

- Schedule 6 to FSMA[2]

- our guidance in the 'COND' part of the FCA Handbook[3]

This document focuses on international firms seeking this type of authorisation.

Authorisation under other UK regimes

International firms that seek FCA authorisation or registration under other regimes will need to meet the minimum standards set out in the relevant legislation.

For example, international firms that need to be authorised under the Electronic Money Regulations 2011 will need to meet the conditions of authorisation or registration in those regulations.

In our view, there will often be similarity between the threshold conditions in FSMA and the minimum standards in other legislation.

As such, while this document focuses on the FCA's objectives and the threshold conditions in FSMA, much of it may also be of interest to firms seeking authorisation under other legislation.

Solo-regulated firms and dual-regulated firms

For regulated activities that require a permission under Part 4A of FSMA, depending on the activities an international firm performs, it will either be:

- solo-regulated by the FCA

- dual-regulated by the FCA and the Prudential Regulation Authority (PRA)

We recognise that there are differences in the regulatory and supervisory frameworks applicable to dual-regulated firms and solo-regulated firms. We will consider these frameworks and the impact they might have on a firm's ability to meet the threshold conditions when conducting assessments.

Dual-regulated firms

The PRA is the lead authority for authorising dual-regulated firms.

Find out more about the PRA’s approach to international firms[4]

Under FSMA, for the PRA to authorise any dual-regulated firm, we must also give our consent. To give consent, we will assess these firms against our threshold conditions for dual-regulated firms, taking account of our statutory objectives.

Our threshold conditions for dual-regulated firms are different to those for solo-regulated firms – these differences are set out in Schedule 6 to FSMA[2] and our guidance in the 'COND' part of the FCA Handbook[3].

Our assessment also has a different focus to the PRA's. Therefore, dual-regulated international firms will wish to consider the issues raised in this document, and the extent to which their structures and the scope of their operations could present the risks identified in this document.

1.2. Our approach

We are committed to a competitive and open financial system. International firms are an established part of the UK's financial services landscape and help the UK to maintain open markets.

Open and vibrant markets, driven by the ability of international firms to efficiently conduct business in the UK, help us meet our objectives.

If an international firm meets the requirements to be authorised, and has good risk mitigation in place, then we will authorise it on that basis.

However, some international firms could present specific challenges. We will not authorise firms if, in light of these challenges, we consider that they do not meet the minimum standards for being authorised.

All individual applications will be considered on their merits and on a case-by-case basis, taking into account all relevant factors by reference to the threshold conditions.

We will pay particular attention to:

- whether the firm is fit and proper

- the extent to which we can supervise the conduct of the firm's UK business

- potential outcomes in an insolvency situation

- the role and accountability of the firm's senior management

- the supervisory cooperation with the firm's home state regulator

We’ve taken into account our experience of regulating firms and managing firm failures, both domestic and international.

Our aim is to:

- act proportionately and be consistent with our strategic and operational objectives

- make sure that standards are maintained, while not undermining our commitment to open markets

2. Our process for authorising international firms

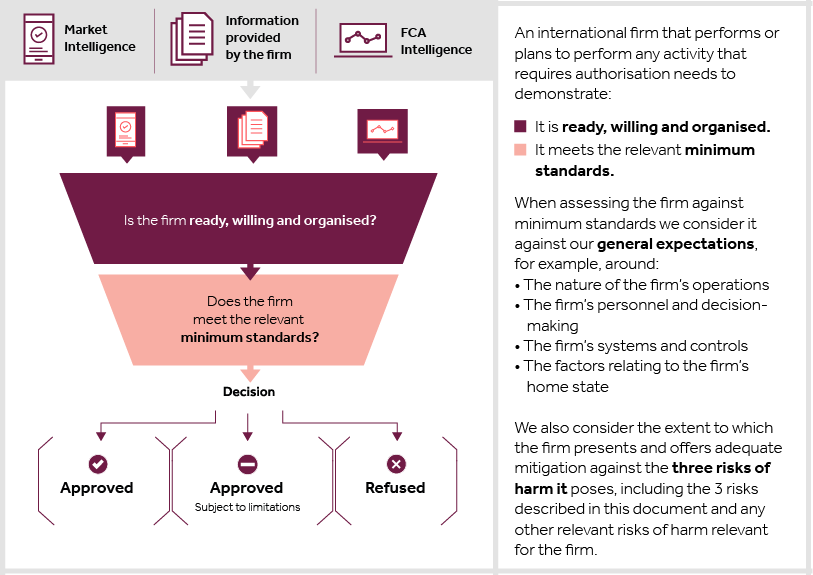

See our approach to assessing international firms in the diagram below.

[6]

[6]

Diagram showing FCA approach to authorising international firms

2.1. Minimum standards for authorisation

Firms that wish to be authorised in the UK need to meet the minimum standards set out in the relevant legislation.

For example, firms seeking Part 4A permissions under the Financial Services and Markets Act 2000 (FSMA) need to meet the relevant threshold conditions.

When deciding whether to authorise an international firm, we apply the same standards with the same statutory objectives in mind as for UK firms.

Once authorised, firms need to meet the minimum standards at all times.

International firms need to consider factors such as:

- the nature of their UK and overseas operations

- personnel or decision-making structures

- their systems and controls

Find out what we expect from international firms

As part of assessing international firms against the relevant minimum standards, we also consider firms' potential to cause harm and the mitigation available.

Read more on risks for international firms

This document focuses on how we make sure international firms meet the minimum standards for authorisation. However, international firms should also be aware that we expect them to continue to meet these minimum standards at all times after authorisation as part of our wider supervisory approach.

2.2. Choosing between branch and subsidiary

International firms have a degree of choice on the legal form of their UK presence. For example, they can serve UK customers from an entity incorporated outside the UK or within the UK.

Where a firm seeks authorisation, this covers the whole entity, including its UK and overseas offices, and we expect it to have an establishment or physical presence in the UK.

We refer to the UK establishment or physical presence of a non-UK entity as a UK 'branch'.

The use of branches is an established part of the UK's financial services landscape. The ability of international firms to efficiently conduct business in the UK helps markets function well, in line with our objectives.

If an international firm meets the requirements to be authorised, and has robust risk mitigation in place, then we will authorise it on that basis. However, we believe that, without appropriate mitigation, certain potential harm could be more likely to occur where the regulated activities are undertaken by international firms from UK branches or overseas offices rather than through UK-incorporated subsidiaries. This is in part because it may be more complex for us to take certain actions in those cases.

In addition, jurisdictional differences may be an issue. International firms operating from UK branches and overseas offices may be subject to regulation and supervision in their home state that also cover aspects of activities in UK branches, thereby overlapping with UK rules and supervision by the FCA.

It will not always be possible for the UK regulatory framework to take full account of the regulation and supervision in every home state, which could evolve over time.

It may also be more difficult for us to influence risks to UK customers from actions and omissions at firms' offices outside the UK.

Insolvency risks

During insolvency, a UK branch will usually be wound up together with its head office as part of the insolvency proceedings for the international firm in its home country.

In some cases, this may make protections less effective for customers of that UK branch.

To account for this, when assessing an international firm against the relevant minimum standards, we will take into account whether a branch’s activities have heightened potential to cause harm and whether those risks can be adequately mitigated.

We will also consider the nature and scale of the activities the international firm intends to conduct from outside the UK.

Individual applications will be considered on a case-by-case basis, taking into account all relevant factors by reference to the threshold conditions.

2.3. Risks of harm for international firms to consider

As part of assessing an international firm against the relevant minimum standards, we:

- consider the firm's potential to cause harm ('risks of harm') and the level of these risks

- find out if the firm can offer sufficient mitigation to address the risk(s) of harm

Three potential risks that are more relevant for international firms, especially (but not exclusively) those operating from branches include:

Across these 3 types of potential harm (as well as other risks relevant to the firm's sector and business model), we will consider:

- home state regulation and supervision where relevant

- the level of international cooperation – this includes information sharing and the firm's recovery and wind-down planning if applicable

- the firm's business model, personnel, and systems and controls

Our assessment will be proportionate to the level of risk posed and how it affects the firm's ability to meet minimum standards.

Find out how we assess risks of harm

We consider how these risks are mitigated on a case-by-case basis.

2.4. Our decisions after an assessment

Authorised

If, after assessment, we take the view that an international firm meets the minimum standards, we will authorise the firm.

Authorised with limitations

We may consider imposing limitations or requirements as part of any approval, for us to be satisfied that the firm will meet minimum standards on an ongoing basis.

- A limitation is placed on a firm's permission to restrict its activities to reduce the potential for harm. For example, we might limit the number or category of customers a firm can deal with, or the number of specified investments that a firm can deal in.

- A requirement is placed on a firm to require it to take or refrain from taking certain action. For example, we might require a firm not to take on new business, or not to trade in certain specified investments.

The power to impose, vary or cancel a limitation or a requirement on a firm is an important tool, allowing us to reduce or prevent harm to consumers and markets.

These can be accepted voluntarily by the firm or imposed on our own-initiative, following due process.

Refused authorisation

If we consider that the minimum standards are not met – for example where any risk of harm identified is not adequately mitigated – we may refuse to permit the firm to conduct the relevant regulated activities.

Re-apply as UK entity

Where the risk of harm cannot be adequately mitigated for an international firm applying to operate in the UK from a branch, but could be mitigated if that firm undertakes the relevant activity through a UK entity, we may invite the firm to apply for authorisation on that basis to undertake the activity in the UK.

3. What we consider

This chapter sets out in more detail some of our main considerations when assessing international firms.

We assess firms providing, or intending to provide, services that need authorisation against the relevant minimum standards.

- For firms that wish to be authorised under the Financial Services and Markets Act 2000 (FSMA), the minimum standards are the threshold conditions.

- Other equivalent conditions apply to firms seeking authorisation or registration under other regimes.

We conduct these assessments:

- when firms apply for authorisation

- during on-going supervision by us

3.1. What we expect from international firms

Below, we outline some general expectations relevant to international firms operating from a UK branch. They may also be relevant for UK subsidiaries with overseas parents.

We will authorise a firm only if it satisfies us that it meets, and will continue to meet, minimum standards.

Our expectations apply to activities that need authorisation. However, when making decisions on a case-by-case basis, we will:

- consider all relevant information (including firm activities that do not need authorisation in the UK)

- assess firms holistically in appropriate circumstances

For example, we will take a firm's behaviour into account, if its unregulated business calls into question whether we should authorise the firm or if it meets our threshold conditions.

3.2. Effective supervision by the FCA

We need to be able to supervise all authorised firms effectively, taking into account:

- complexity of the firm's regulated activities and products

- how the business is organised

In our view, effective supervision includes being able to:

- access relevant information

- monitor on an ongoing basis

- make regulatory interventions to respond to specific harm or events

To supervise a firm's UK activities effectively, we expect a firm to have an active place of business in the UK.

Typically, a firm's local presence should be more than a UK registered address.

We will also need assurance that the following are adequate for effective supervision:

- personnel (including management and decision-making structures)

- systems and controls (taking into account any offshore or outsourcing dependencies)

Where relevant, we will also assess whether the UK operations are appropriately financially resourced by the firm as a whole. This is to avoid the risk that the firm cannot meet any legal and regulatory obligations arising from the branch's operations.

In considering the context of a firm's wider operations, we will assess cooperation between the FCA and the home state supervisor. This includes the:

- existence of cooperation agreements

- ability to exchange confidential information

We also consider the firm's business model and assess whether the firm carries out its strategy for creating value:

- in a sound and prudent manner

- in the interests of the consumers it serves

3.3. Personnel and decision-making

When considering if a firm's resources are suitable and appropriate, we will consider if the firm can comply with the Senior Managers and Certification Regime (SMCR)[9].

In broad terms, these rules require firms to have in place:

- effective governance structures and management oversight

- clearly defined accountability for individual senior management

Aspects of the SMCR apply to international firms that have a UK branch.

We will also consider other relevant rules, such as on individual conduct in the FCA's Code of Conduct sourcebook (COCON)[10].

Decisions will be taken on a case-by-case basis. However, we would typically expect senior managers who are directly involved in the firm's UK activities to spend an adequate and proportionate amount of time in the UK to make sure those activities are suitably controlled.

We recognise that individuals with purely strategic responsibilities for the UK branch may not be based in the UK.

We expect individuals responsible for the day-to-day management of the UK branch activities to:

- have sufficiently independent decision-making powers

- exercise independent challenge over strategic decisions that affect the wider firm

Before we authorise an international firm to operate from a UK branch, we will need appropriate assurance that its decision-making framework is adequate for its activities both:

- in the UK branch

- at the wider, strategic level

3.4. Systems and controls

Any firm authorised to operate in the UK must also have appropriate non-financial resources including systems, controls and human resources.

Outsourcing arrangements should not impair the quality of the firm's governance and internal controls and our ability to supervise it.

Where an international firm's UK operations depend on services provided from other locations of the firm, we will consider whether these arrangements could impair our ability to supervise the firm effectively.

3.5. Home state jurisdiction

The authorisation of a firm applies to the entire firm including its overseas offices.

This means for an international firm, the authorisation will apply to the legal entity incorporated outside the UK, including its UK branch and its overseas head office.

Firms operating from branches will also often demonstrate a high degree of interconnectedness between their UK and international establishments.

As such, we must have comfort over the jurisdiction where the firm is incorporated, and how the arrangements in that jurisdiction affect the firm's ability to meet the relevant minimum standards for authorisation.

For instance, to assess whether the firm has appropriately financially resourced its UK operations and to avoid the risk that the firm cannot meet any legal and regulatory obligations arising from the UK operations, we will take account of the comparability of:

- relevant home state regulation

- wind-down plans

- whether the home state has implemented and complies with relevant global standards

This includes, for example, whether the specific activities that the firm wishes to carry out in the UK from a branch are prudentially regulated in its home state.

We will take account of the supervisory cooperation with the relevant home state regulator(s) which will inform our assessment of the firm's ability to meet the relevant minimum standards, for example, whether it can be effectively supervised.

3.6. International firms providing services from outside the UK

When an international firm becomes authorised, the whole firm, including its overseas offices, benefits from the permissions granted. Therefore the whole firm must meet our minimum standards at the point of authorisation and on an on-going basis.

If such a firm intends to provide some services that require authorisation to UK customers from overseas (ie anywhere other than a UK establishment), we will seek to make sure that this is appropriate and that we can effectively supervise services provided to UK customers in this way.

In doing so, we will consider how much assurance we can take from our supervisory relationship with the firm's UK establishment (in addition to other factors), for example, the extent to which the UK branch has oversight of activities provided to UK customers from overseas.

Depending on firms' activities and how those activities are performed, some of our rules may not apply in the same way or to the same extent if the services are provided from the home state or anywhere other than from an establishment in the UK.

This is notwithstanding the specific status disclosure obligations in GEN 4.4 of the FCA Handbook[11] for firms doing business with retail clients from non-UK offices.

This may present risks of harm in addition to those discussed in this document, or make the harm discussed in this document more acute. For example, business conducted from a UK branch may be covered by the Financial Services Compensation Scheme, whereas the same service provided to UK customers from the firm's home state may not.

Where UK regulatory protections are not available, we will seek to understand the extent to which non-UK protections are available for UK consumers in their place.

Where we identify specific risks of harm arising from services being provided from an establishment outside the UK, we:

- first work with the firm to identify mitigations which could include changing how it provides services

- may invite the firm to consider providing some or all of these services from the UK branch

- where appropriate, may agree limitations or requirements with the firm to mitigate the risk

For example, where an international firm needs authorisation and proposes to continue to provide some services from its home state to a limited class of consumers and mitigates the risks sufficiently for that class of consumers, we may formalise this arrangement via a limitation on the firm’s permissions.

Ultimately, if we are not content with your firm's plans, we may:

- impose a limitation or requirements using our own-initiative powers

- refuse the firm's application for authorisation

4. Assessing an international firm's risks of harm

As part of our assessment of a firm for performing activities that require authorisation against minimum standards, we consider the firm holistically for the potential for harm it may pose ('risks of harm').

International firms may cause harm depending on their business model and how their businesses are structured.

In this section, we expand on the 3 broad categories of harm that are particularly relevant for international firms:

- performing regulated activities from a UK branch and serving retail customers (retail harm)

- holding client assets (client asset harm)

- conducting wholesale businesses (wholesale harm)

While these risks are relevant to international firms operating from branches, they could also be relevant to firms operating other structures. We will consider all risks of harm that are relevant for the firm's sector and business model.

4.1. Retail harm

Our focus here is on international firms that conduct regulated activities with retail customers. This may include firms that manufacture products which are ultimately sold to retail customers.

We are concerned about the risk of harm from the non-payment of redress applicable under the relevant UK rules. This is because, although UK branches of international firms will generally be subject to the same regulatory redress requirements as UK firms and the same Financial Services Compensation Scheme (FSCS) cover, a person in the UK seeking redress from a branch of an international firm may be more dependent upon the cooperation of the international firm's head office or, in the case of the firm's insolvency, the position of UK consumers under the home state's insolvency rules and/ or the FSCS.

This can pose a risk of harm to the following types of retail customers:

- 'eligible complainants' to whom the Financial Ombudsman Service ('the ombudsman') has made awards

- 'consumers' who can claim redress through other routes (as per the first paragraph of the Handbook glossary definition, which defines consumer as a 'natural person acting for purposes outside his trade, business or profession')

- 'eligible claimants' who could rely on the FSCS for compensation in the event of unpaid redress

Examples of harm that could occur with an international firm include where the firm is solvent, but refuses to make payment of redress, and has insufficient assets in the UK to satisfy such claim.

In such circumstances:

| FSCS cannot offer compensation | The FSCS would be unable to pay any compensation where the firm is simply unwilling - rather than unable - to pay its redress liabilities. |

| Barriers to enforcement in home state |

The consumer may have to seek enforcement action in the firm's home state, which will have different procedures and laws to the UK. Such enforcement action may be complex, expensive and time consuming. As a practical matter, it may require legal representation before the foreign court. The foreign court may also draw a distinction in the nature of the redress. For example, it may take the view that the ombudsman award is not a judicial decision and may require the dispute to be re-litigated from scratch. |

| Defensive action from the firm |

The firm may take defensive action to resist enforcement, such as by seeking judicial declarations or anti-suit injunctions in the courts of its home state. It may also seek to dissipate any assets it may have in the UK. |

| Barriers to UK regulator action |

It may be more difficult for UK regulators to take effective action. For example, if a fine is levied, but the firm refuses to pay, the foreign court may refuse to enforce the payment of the fine on the basis that the fine is the sovereign act of a foreign state. |

On the other hand, harm can also occur where the firm is subject to home state insolvency laws. Under these circumstances, where the firm is subject to home state insolvency laws, then:

| Eligible FSCS-protected claims |

Consumers with FSCS protected claims who are eligible will be able to claim compensation from the FSCS up to the relevant limits. However, this is not possible for certain claims that are not FSCS-eligible, such as - in general - those relating to consumer credit or loan-based crowdfunding or where customers pursue their claim themselves where their claim exceeds FSCS limits. |

| Not eligible for FSCS |

Consumers whose claims are not FSCS-eligible or who pursue their claim themselves where their claim exceeds FSCS limits may have to prove their debts under the foreign court's insolvency procedures and the laws of the home state. This may add significant complexity, expense, and delay to the enforcement action. As a practical matter, it may require UK consumers to seek legal representation in the firm's home state to liaise with the liquidator and to pursue any disputes before the foreign court. If the firm is heavily insolvent, the additional expense may further reduce the funds available for unsecured creditors, to the point that it is uneconomic for the UK consumers to pursue their redress. |

| Non-FSCS eligible claims | If consumers with non-FSCS eligible claims have already taken steps to secure redress in the UK before the firm became insolvent, they may need to start afresh under foreign insolvency proceedings. |

Recurring risk factors

In our experience, higher incidences of consumer harm resulting in complaints (which can lead to redress) are typically associated with recurring factors such as:

- poor quality of governance leading to inappropriate sales practices (including failing to establish customer needs, or conduct affordability checks)

- inadequate disclosure of product information resulting in consumers being unable to effectively engage with the product

- inadequate management of conflicts of interest between how firms generate revenue and consumer needs

- flaws in the design and implementation of systems and controls

- failure to hold adequate professional indemnity insurance and capital to meet liabilities

- inadequate arrangements to maintain technology resilience and cyber security

- failure to establish adequate controls to prevent financial crime such as scams

When assessing any firm – UK entity or international firm – we will pay close attention to factors such as these. However, international firms may pose increased risk relating to non-payment of redress. In addition, international firms are typically dependent on their head offices and other overseas offices, and the above factors may be exacerbated if:

- firms have not appropriately adapted their business to suit the UK market or regulatory requirements

- there’s insufficient supervisory oversight of the relevant overseas offices

So, when assessing an international firm, we will pay more attention to the risk of these factors occurring and what assurances can be provided by the firm to mitigate them.

4.2. Client assets harm

Our focus here is on international firms that: safeguard custody assets or receive or hold client money (collectively referred to as 'client assets'), in particular, client assets subject to the FCA's Client Assets Sourcebook (CASS)[12].

However, international firms that safeguard funds subject to the Electronic Money Regulations 2011 should also consider how this risk of harm might apply to them.

If an international firm safeguards client assets from a UK branch, firms must generally comply with UK rules on the protection of client assets while the firm is a going concern (in particular, the CASS rules). There could be a mismatch between these UK protections and the home state laws and, depending on the home state laws, this could negatively impact the protection for the client.

In insolvency, while it may be possible for a winding-up application to be made to a UK court, it is more likely that the international firm as a whole (including the UK branch) will be subject to the insolvency regime and procedures of the international firm's home state.

An insolvency practitioner appointed in the home state may not be in a position to observe UK protections when distributing assets. As a result, the protections offered by the applicable provisions of CASS, in conjunction with UK property and insolvency law, might not be applied if the insolvency is administered in line with the home state's laws, might only be partially applied, or might be applied only if certain conditions are met.

There is a possibility that clients' assets will not be ring-fenced as CASS and UK law had intended. This could be an issue if, for example, the client assets are made available to the international firm's general creditors as part of the general insolvency estate of the firm, and clients for whom assets were safeguarded under CASS have to prove their claims as creditors rather than beneficiaries to property.

Insolvency regimes across different jurisdictions can vary considerably and there is little harmonisation of insolvency law at an international level.

We will expect international firms to have considered the risks to client assets and how to address them. This could include:

- seeking legal advice on the specific circumstances of the firm and its proposed UK branch in the context of the insolvency regime of its head office's jurisdiction

- assessing the implications of its recovery and wind-down plans (or resolution plans where relevant) on the customers of the UK branch

When assessing whether this harm can arise in particular situations, questions that we are likely to consider include:

Even with specific advice, outcomes of insolvency proceedings are difficult to predict.

For solo-regulated firms that operate in more than one country, international authorities rarely agree which tools they should use to ensure an orderly wind-down. Nor is there always sufficient international cooperation to manage such insolvencies.

We therefore have limited tools at our disposal to ensure protections and outcomes equivalent to those in the UK.

In contrast, there is a degree of international standardisation on which tools resolution authorities should use for dual-regulated firms. We will factor this into our case-by-case assessment for these types of firms.

4.3. Wholesale harm

Our focus here is on the potential risk of harm to UK financial markets and the UK economy that could be caused by an international firm operating in, intending to operate in, or otherwise connected to these markets.

While we are committed to maintaining a competitive and open financial system, this must not come at the expense of market integrity. In some cases, firms (particularly those in the wholesale market) could cause disruption affecting the UK financial system if they are in distress or undergoing a disorderly failure.

It may be more difficult for us to effectively identify shocks or prevent risky behaviours that originate from an international firm's activities outside the UK but could cause significant negative impact in UK markets. This may be particularly likely if:

- the firm's UK branch is highly interconnected with, or reliant on, its overseas offices

- there's not enough supervisory cooperation in oversight and information sharing

Some common factors that can increase a firm's potential to cause harm in UK markets include:

- not enough ability to substitute the products and services the firm offers in the UK market(s) where it operates

- if the firm holds an important position in the UK market – for example, it has a significant share in a niche market or other influence

- the firm is interconnected to other firms in the industry, and spreads and amplifies risks in the system rather than reducing or absorbing them

We will pay more attention to international firms that display the factors above, and will consider each firm's specific circumstances when we assess its risk of harm.

As the PRA leads on the prudential supervision of dual-regulated international firms, we will discuss any relevant concerns with the PRA as well as the firms concerned.

We are responsible for the prudential supervision of solo-regulated international firms. We believe that, in general, solo-regulated branches are less likely to reach a scale or scope that could cause market disruption or other related harm that undermines market integrity. However, we will consider this on a case-by-case basis.

5. Mitigating identified risks

As part of our assessment of an international firm, we consider whether it offers adequate mitigation against the risk of any harm identified.

This chapter provides examples of the ways international firms might be able to mitigate the 3 risks of harm highlighted in Chapter 4:

- retail harm

- client asset harm

- wholesale harm

If any other risks of harm are identified in an assessment. the firm should also seek to mitigate those risks as well.

All firms are different and so the actions one firm takes to mitigate its risks of harm might not be suitable for another firm.

Where we have concerns, we would in the first instance ask the firm to explain how risks of harm would be mitigated. Our assessment of mitigation will be commensurate to the level or risk posed. Where appropriate we may agree with the firm the relevant limitation or requirement to mitigate the risks.

If we still have residual concerns, we may decide to authorise the firm subject to a limitation or requirement that it must meet from the point of authorisation. This could include, for example, limiting the number or type of UK retail customers it can serve or requiring the firm to report specified information to us on an on-going basis or if certain triggers are met.

Ultimately, however, we will refuse a firm's application if none of those actions is sufficient to address our concerns and we do not consider that the minimum standards for authorisation are met.

We will take the steps we consider necessary to advance our operational objectives.

5.1. Retail harm

International firms planning to serve retail customers need to show they adequately mitigate the risk of retail harm.

This may be more difficult for firms whose business and operational models show a higher propensity for causing harm to consumers.

Retail harm can arise where an international firm:

- holds insufficient resources to compensate its UK retail clients during firm failure

- decides to exit the UK market without compensating its UK retail clients

Some factors make retail harm less probable. We will take these factors into account when considering a firm's ability to:

- mitigate the risk of retail harm

- meet minimum standards

There may be firm-specific factors which might reduce the likelihood of the firm seeking to avoid its responsibilities.

For example, if there would be a particularly adverse impact on the firm's reputation in other markets if it were seen to treat UK customers unfairly, or if the FCA could rely on the home state regulator to obtain compensation from the firm, then the firm may be less likely to try to avoid its responsibilities in the UK.

Factors that may reduce the likelihood of firm failure and of firms holding insufficient resources to compensate retail clients include, for example:

- the level of prudential scrutiny and supervision applied to firms in their home state

- the extent of any ongoing monitoring of recovery and wind-down plans (where relevant)

- the degree to which UK authorities may be involved in the recovery and planning process

For firms with resolution arrangements, we will also take account of the extent of international cooperation for those arrangements.

To assess the level of protection an international firm offers to UK customers, we will consider:

- the firm's home jurisdiction to understand the comparability of redress rules and supervisory approach, consulting the home state regulator where appropriate

- the level of cooperation between the FCA and the home state regulator

We will review each application on a case-by-case basis, including considering the nature and scale of the retail business.

We will expect mitigants to be commensurate with the likely level of risk, for example, the size of the firm's retail business.

We will also consider the relationship between the branch and its head office, to identify whether we could gain additional assurance from how the branch is structured or resourced.

For example, we’ll consider whether and to what extent:

- the branch has its own management in the UK or independent oversight as part of its governance structure, or is heavily influenced by executives at the head office

- the systems and controls are well-suited to the operation of the branch in the UK (especially if they are derived from the policies and practices of the head office)

- the people exercising control functions (for example for compliance, audit and risk) have adequate UK regulatory or legal experience and knowledge of the UK market

- the products and services that are developed by the head office or by other overseas branches are suitable for the UK market

- the conflict of interest and other relevant polices derived from the head office are sufficiently localised to ensure that expectations under UK laws and regulations are adequately met

We will use our experience of similar firms to inform our assessment of a firm's potential harms and its mitigants.

When assessing whether its mitigants are adequate, we will take account of the history of redress and consumer complaints for firms with similar business models. This means, in general, we consider that it is likely to be more difficult for firms to satisfy us that they can adequately and sustainably mitigate the risk of retail harm if we have seen significant concerns arising from firms with similar business models.

Where mitigants do not adequately address the retail harm, we will consider options such as limitations or restrictions on the business to focus on activities where we are more comfortable about the potential level of harm.

In some cases, establishing a UK subsidiary for the relevant part of the business may help to reduce the risk of harm.

5.2. Client asset harm

International firms planning to safeguard client assets need to show they adequately mitigate the risk of client assets harm.

The likelihood of this risk and mitigation measures depend on how home state laws treat client assets safeguarded under UK rules.

Client asset harm can arise when there is a misalignment between:

- the UK rules which apply for client assets safeguarded from a UK branch when the international firm is a going concern

- the insolvency laws which apply when the firm becomes insolvent

We will expect firms to satisfy us that the risks are appropriately mitigated, including, where relevant, by providing us with information about their clients and how their assets safeguarded from a UK branch would be treated if the firm enters into insolvency proceedings.

We will expect firms to:

- have considered the risk of harm

- explain the mitigations they will put in place

We anticipate that we will need to consider these mitigations with reference to how client assets are held and safeguarded. We will consider the risk of harm for client money and custody assets separately.

For example, one possibility that credit institutions can consider is to hold money that would otherwise be classified as client money as a deposit under the 'banking exemption' set out in CASS 7.10.16R of the FCA Handbook[13] (as many such firms do already).

In this situation, the position of depositors in insolvency is likely to be more certain.

For custody assets, in some cases, ensuring assets are registered in a manner consistent with both home and host state laws may be sufficient to mitigate the harm, depending on the insolvency law in the relevant jurisdiction.

In certain circumstances, clients of the UK branch may accept, and even expect, that the insolvency law in the home state where the international firm is incorporated will apply.

For example, an European Economic Area (EEA)-based insurance distributor may wish to set up a UK establishment to access the London Market and only seek to serve EEA-based clients through the UK branch.

In such a situation, we may accept the relevant activities being undertaken through the UK branch, but it would be important that the firm makes suitable disclosure to its clients.

Options to consider

lf we still have concerns after these considerations, one option an international firm could consider is to structure its arrangements so that client assets are not safeguarded from its UK branch, to the extent that doing so would better protect custody assets.

The firm may wish to:

- conduct the custody asset activity from an establishment in the home country (such as the firm's headquarters) where the home state provides its own protections

- arrange for the client to appoint another person who has the appropriate permissions to act as its custodian in the UK (with the firm possibly retaining a mandate over the custody account so that it can still service the client's transactions)

When arranged appropriately, this could ensure that there is consistency between the safeguarding regime that applies during the life of the firm and the law that would apply in an insolvency.

Establishing a UK-incorporated subsidiary is another option for international firms to consider, where this could ensure that there is consistency in the treatment of client assets in the UK between:

- the safeguarding regime that applies during the life of the firm

- the law that would apply in an insolvency

We are mindful that these options may raise practical questions for individual firms to consider, and that other kinds of mitigations may adequately address the risk.

5.3. Wholesale harm

International firms planning to provide wholesale financial services need to show adequately mitigate the risk of wholesale harm.

For most firms, this risk will be small, as they are unlikely to have the scale or scope to have an impact on wider market integrity.

Wholesale harm can arise when shocks or risks originate from an international firm's overseas offices which may:

- be more difficult for us to identify and prevent

- have a negative impact on its UK branch and the integrity of UK financial markets

We believe there is, in general, less scope for the UK branches of solo-regulated international firms to reach a scale or scope that causes widespread issues of market integrity in the UK. We discuss dual-regulated international firms with the PRA, including those that are systemically important.

Where the size and nature of the firm as well as its interconnectedness with the wider market mean it could pose a significant risk to market integrity in the UK, especially if the firm were to become distressed or fail, we may discuss with the firm how we can most effectively supervise the firm or manage its risk of harm to the UK markets.

On a case-by-case basis, we will consider how likely is this risk of harm to become real and what mitigants are in place and whether they are adequate relative to the level of risk.

Relevant factors include, for example:

- the level of supervisory cooperation

- which prudential regime the firm is subject to

- the credibility and quality of its wind-down planning

If a firm subject to international resolution plans and arrangements (such as laws carrying out the Bank Recovery and Resolution Directive) enters financial difficulties, we will consider how confident we are that respective resolution authorities can use a pre-agreed plan to minimise disruptions to wholesale markets. This is especially the case where a plan aims to avoid failure as well as managing its consequences.

We are also aware that firms may be able to take extra steps to reduce our concerns over any risk posed to the integrity of UK markets. We will take these into account when assessing whether the risk has been adequately mitigated.

If we consider the risk of harm would only be mitigated if the international firm were to operate through a UK entity or transfer the relevant activity to another entity, we may invite the firm to consider applying for authorisation on that basis.

Annex: Potential impact of our approach

In this document, we set out our general approach and our views on the risks of harm international firms might present.

We are not making any changes to our rules, so we are not required by statute to set out a cost-benefit analysis.

We believe it is helpful nonetheless to set out at a high level our views of the potential impact of the approach.

In summary, we believe the approach achieves an appropriate balance and will deliver benefit for:

- firms

- consumers

- our resources

We are mindful, however, that it would be impracticable for us to attempt to precisely assess the costs and benefits.

Our approach does not prescribe specific outcomes for international firms and allows firms flexibility to choose how they structure their businesses to provide regulated services in the UK, as long as they can do so in a way that that meets minimum standards and mitigates any risks of harm identified.

The costs are highly sensitive to the specific circumstances of individual international firms and their clients, and depend significantly on the strategies each firm chooses to pursue, which will be affected by factors beyond this document.

1. Firms

This approach document will be relevant to international firms applying to perform or performing regulated activities that require authorisation in the UK.

We expect these firms to have appropriate arrangements for their operations, systems and controls, and personnel and decision-making in relation to their regulated activities in the UK.

We also expect that they have some form of UK presence, to make sure that we can effectively supervise them for the regulated services they provide. This will impact international firms that do not have any UK presence but wish to be authorised to operate in the UK in future. Firms that already have an establishment in the UK are likely to be less impacted.

We also expect that these firms mitigate the 3 risks of harm outlined in the document, in addition to any other risk of harm identified in our assessment of individual firms.

The 3 risks of harm are relevant for international firms needing authorisation and carrying out or intending to carry out the following activities:

- undertaking retail business, specifically business with a 'consumer', an 'eligible complainant', or an 'eligible claimant' as defined in Chapter 4[14]

- safeguarding client money or custody assets from their UK establishment

- undertaking business in wholesale UK markets in the UK

To meet our expectations and mitigate the relevant risks, some of those international firms may need to make operational or financial changes to their businesses. Some may need to restrict or limit their businesses to activities that do not pose significant risks.

Costs will depend on the level of risks the firm poses and its existing arrangements. These may include:

- one-off costs from restructuring, for example from changing a firm’s systems or transferring its businesses to another firm

- ongoing costs from the relevant requirements that being authorised will entail

Some firms may choose not to enter the UK or may choose to reduce their existing UK footprint if they cannot adequately mitigate the risks they pose in a way that is commercially viable. This could affect competition.

We cannot know for sure what proportion of firms will present which risks and what proportion will elect to do which of the above. We also cannot know whether a firm's decision to restructure or exit the UK will be in response to our approach or other factors that affect the cost of doing business. As we have made clear, our approach allows for a range of possible outcomes, and we will refuse to allow an international firm to operate in the UK only if we consider that it cannot meet minimum standards.

By setting out our approach publicly, international firms that plan to perform activities that require authorisation will have a better understanding of our expectations. This is likely to help firms decide how best to structure their businesses before they apply for authorisation and facilitate the application process, which could reduce the costs to the firms and the time the process would take. This will reduce the likelihood of an unsuccessful application, for example one that is refused because of risks that could have been mitigated before the application was made. This will minimise the expense and effort that come with making a new application.

The approach will not affect international firms that are not providing, or not intending to provide, financial services that require authorisation.

2. Consumers

Consumers could benefit from our expectation that international firms consider the impact they may have on UK clients throughout the life of the firm including during recovery, wind-down or insolvency. This reduces the risk of consumers facing additional costs and delays when seeking to recover redress or retrieve their client assets, because only international firms which can demonstrate an ability to adequately mitigate these risks will be permitted to operate.

Consumer confidence in the overall market is likely to improve as a result.

Consumers may also become more confident in using the services provided by international firms authorised by us, which could promote competition in the relevant markets.

3. Our resources

The FCA will be able to refer to our published approach in discussions with firms about applications for authorisation and on-going supervision, which could allow us to use our resources more efficiently and discharge our functions more effectively.

By reducing the risks of harm when we assess firms, we also reduce the likelihood that the risks materialise to cause harms to consumers and markets which would likely be more costly to address.