William Matcham of the London School of Economics and Political Science and FCA economist Jonathan Shaw use the FCA's 2015 Credit Card Market Study dataset to investigate how UK lenders base choices on customers' risk.

Economists use price to understand why markets work or fail. In financial markets, much of the discussion on fairness similarly focuses on risk-based pricing[1]. However, in credit card markets lenders also set credit limits. This feature creates new economic questions. For example, are credit limits risk-based? Are market-based credit limits best for consumers?

We studied variation in interest rates and credit limits using data collected for the FCA 2015 Credit Card Market Study (CCMS). The dataset covers 74 million credit cards used between 2010 and 2015 – approximately 80% of the market. Our main finding is that lenders managed credit card default risk using credit limits, not interest rates.

The absence of risk-based pricing

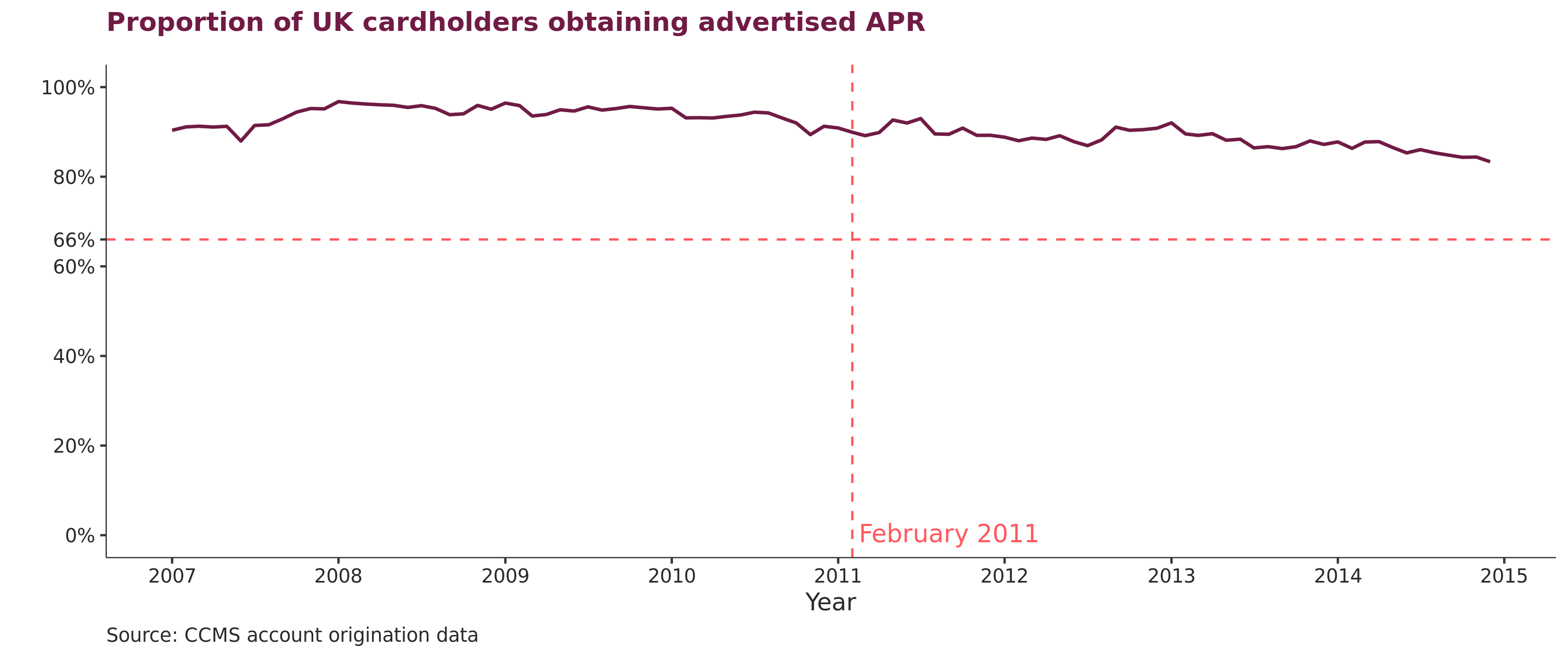

We began by examining interest rates, specifically Annual Percentage Rates (APRs). As shown in Figure 1, 80 to 90% of customers between 2007 and 2015 got the APR advertised in the credit card summary box.

This proportion did not change in February 2011 (vertical dashed line), when the UK harmonised its regulation on the definition of an advertised APR to align with the European Union. Before harmonisation, the regulation required that at least 66% of customers taking the card got the advertised APR or lower (horizontal dashed line); post-harmonisation, the threshold fell to 50%.

Figure 1: Proportion of customers obtaining the advertised APR over time

Proportion of UK cardholders obtaining advertised APR

A few subprime lenders priced differently, dragging down the line in Figure 1. To investigate, we calculated percentage point differences between the advertised APRs and those that customers actually received.

The differences are small and often favourable to consumers. In the most commonly occurring case, 43% of customers received an interest rate six percentage points lower than that advertised. Very few customers (around 2.5%) got interest rates more than eight percentage points above the APR advertised.

These lenders' combined share of all originations was approximately 6%, and not all subprime lenders used risk-based pricing on their cards. Others in this dataset followed many prime lenders in giving all customers the advertised rate.

These findings demonstrate limited risk-based pricing within credit cards in the UK credit card market between 2007 and 2015.

Risk-based credit limits

If interest rates didn't vary on credit cards, did credit limits? The answer to this question is yes, but the extent of variation differed across lenders. As shown in Figure 2, one lender (left panel) in the sample gave 99% of their customers one of 13 specific credit limits, ranging from £1,500 to £5,500. Another lender (right panel) used 294 distinct limits for the same proportion of its customer base.

The smoothness of the right-hand curve shows a lender with a detailed and finely tuned process of assigning credit limits to individual customers. In contrast, the left-hand lender assigned limits to groups of customers, which generates the steps in the figure. Both, however, varied credit limits on their cards: there was no notion of constant credit limits on UK credit cards.

Figure 2: Percentiles of credit limits at two lenders in the CCMS Sample

Percentiles of credit limits at two lenders

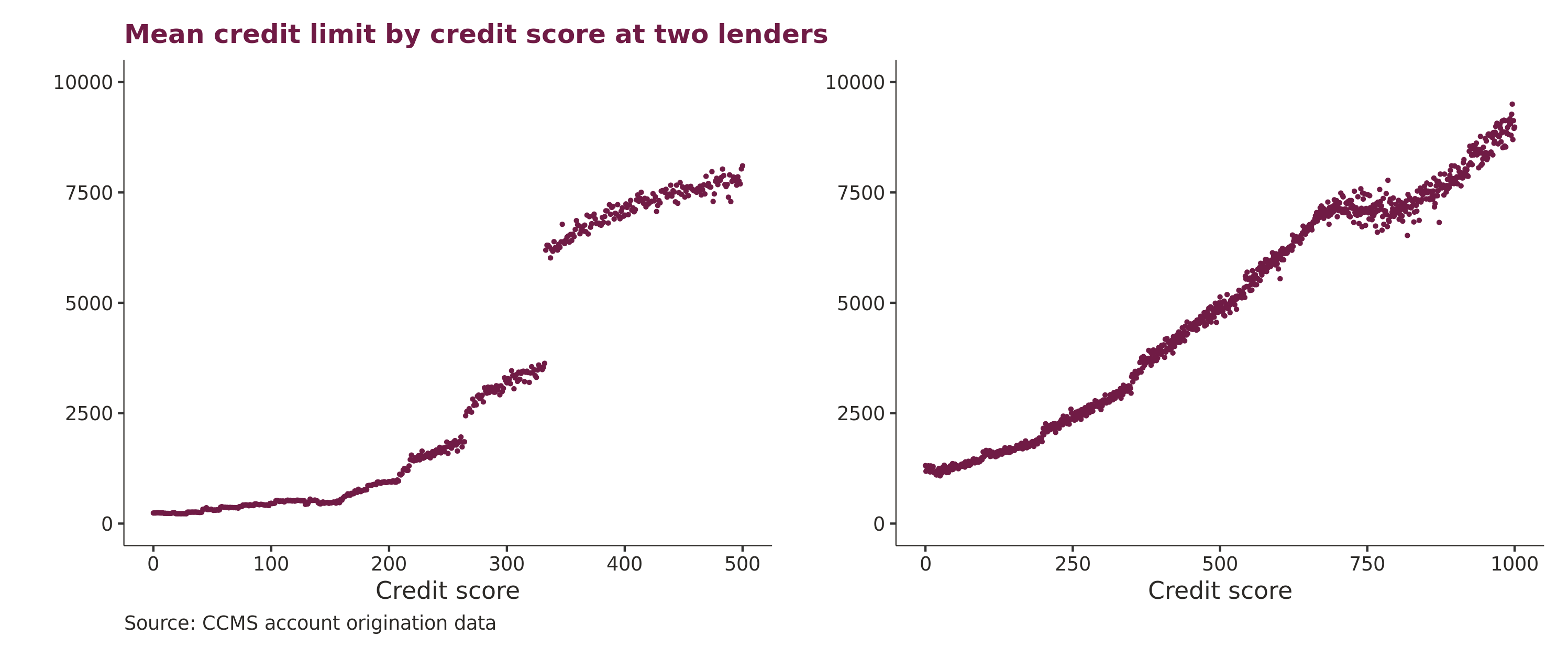

An individual's credit limit also depended on their credit score. Figure 3 plots two lenders' mean credit limit for each of their proprietary credit scores.

Both curves slope upward, consistent with risk-based credit limits. The left-hand panel shows a lender with jumps in credit limits at certain credit score thresholds. The right-hand panel shows a lender without any jumps.

Figure 3: Average credit limits by credit score at two lenders in the CCMS Sample

Mean credit limit by credit score at two lenders

With or without jumps, all credit card lenders used risk-based credit limits. But lenders differed in how much they based credit limits on risk. Some lenders fine-tuned credit limits precisely to their measure of customer risk; others adopted a simple scorecard, changing credit limits discretely at a limited number of thresholds.

Concluding remarks

To understand why lenders individualised credit card deals through credit limits, we looked at the other half of the equation – the consumer. According to our survey evidence (including the CCMS survey[2]) customers based their credit card choices on 0% promotional deal periods, rewards, and, to a lesser extent, interest rates.

Responses hardly ever mentioned credit limits. We believe that lenders used interest rates and promotional deals to compete over cardholders and credit limits as a risk management tool. Through credit limits, firms capped borrowing by risky customers, even when they offered them a lower interest rate or more advantageous promotional deal than their risk score justified. We saw nothing suggesting a change in this strategy in the three years following the harmonisation with EU regulation.

The remainder of this research, to be finished later this year, estimates an economic model of the UK credit card market. The model predicts the economic outcomes from different combinations of risk-based prices and risk-based credit limits. These predictions can inform ongoing policymaking on risk-based prices in credit markets.