Guidance for reporting under the revised UK EMIR Article 9 reporting requirements.

On this page

On 24 February 2023, we published a joint Policy Statement (PS23/2) with the Bank confirming changes to the derivative reporting framework under UK EMIR.

The majority of the new requirements are applicable from 30 September 2024, with a transition period for some aspects.

You can read our guidance below on how the updated reporting framework will be implemented. This guidance is in the form of questions and answers (Q&As) grouped into topics. The Q&As are applicable from 30 September 2024 in line with the majority of the new requirements.

Questions and answers (Q&As)

Under Article 9 of UK EMIR, the Bank of England (the Bank) and the FCA (together, the Authorities) share responsibility for derivatives reporting. The Bank is responsible for central counterparties (CCPs) and the FCA is responsible for all other counterparties in addition to trade repositories (TRs). Any references to 'we', 'us' and 'our' in these Q&As should be read in this context.

The Q&As should be read in conjunction with the FCA/Bank of England Policy Statement (PS23/2) and the supporting documentation below (which are collectively referred to as the 'new requirements'):

- The FCA Standards Instrument

- The technical specification documents:

- XML schemas under UK EMIR (applicable from 30 September 2024), together 'the XML Schemas'

- Incoming messages to TRs (ZIP 4.4MB)

- Outgoing messages from TRs (ZIP 8.3MB)

- UK EMIR Validation Rules (applicable from 30 September 2024)

- The European Market Infrastructure Regulation Rules (EMIRR) for TRs

- XML schemas under UK EMIR (applicable from 30 September 2024), together 'the XML Schemas'

These Q&As apply in relation to the new requirements applicable from 30 September 2024. Reporting counterparties should take a pragmatic approach in considering the application of these new Q&As alongside any existing guidance, including circumstances where the new Q&As may supersede them. In due course, and as part of the programme of repealing and replacing assimilated law, we intend to review existing guidance and consider where it remains relevant.

1. Transitional arrangements

The new requirements come into effect on 30 September 2024.

From 30 September 2024 all newly entered or modified derivative trades at both trade and position level will need to comply with the new requirements.

For derivative trades entered into before 30 September 2024, there will be a 6-month transition period for entities responsible for reporting to update those outstanding derivative reports to the new requirements. This ends on 31 March 2025.

This set of Q&As relates to the arrangements for transitioning to the updated derivative reporting framework under UK EMIR during the period from 30 September 2024 to 31 March 2025.

1.1 How should derivative reports entered into before 30 September 2024, that have not been updated to comply with the new requirements at the conclusion of the transition period on 31 March 2025, be treated?

Our expectation is for all entities responsible for reporting to ensure any outstanding derivative reports are updated to comply with the new requirements by the end of the transitional period on 31 March 2025.

We will monitor progress during the 6-month transition period. We expect entities responsible for reporting to proactively engage with us ahead of the completion of the transition period, with explanation, if they are at risk of not updating their outstanding reports to comply with the new requirements after 31 March 2025. We may consider using our supervisory powers in a proportionate and risk-based manner in the event of firms failing to meet the new requirements.

1.2 Should TRs terminate any derivative reports entered into before 30 September 2024, that have not been updated to comply with the new requirements, at the conclusion of the transition period on 31 March 2025?

No. TRs should not unilaterally terminate outstanding derivative reports that have not been updated to comply with the new requirements after 31 March 2025.

TRs should take all reasonable steps to encourage entities responsible for reporting to ensure their outstanding derivative reports are updated to comply with the new requirements by the end of the transition period. However, it is the responsibility of entities responsible for reporting to ensure all outstanding derivative reports comply with the new requirements by the end of the transitional period on 31 March 2025.

We will monitor progress during the 6-month transition period. We expect entities responsible for reporting to engage with us, with explanation, if they are at risk of not being able to update their outstanding reports to comply with the new requirements after 31 March 2025. We may consider using our supervisory powers in a proportionate and risk-based manner where firms fail to comply with the new requirements.

1.3 Will outstanding derivative reports, that have not been updated to comply with the new requirements, be subject to reconciliation during the transition period?

Yes. TRs should include all outstanding derivative reports in the reconciliation process (see Section 2 Reconciliation for further detail on the reconciliation process) regardless of whether they have been updated to comply with the new requirements or not. Reconciliations should be based on the new requirements only. Only fields required to be reconciled under the new requirements should be subject to reconciliation. Fields that are no longer required under the new requirements do not need to be reconciled.

We are aware this approach will result in reconciliation breaks during the 6-month transition period, particularly where one counterparty reporting a trade may have updated a report to comply with the new requirements, but the other counterparty, reporting the same transaction, has not. However, we expect this to be a short-term issue, which will reduce as more reporting counterparties update their reports to comply with the new requirements. We will monitor progress during the 6-month transition period.

1.4 Should TRs maintain the reconciliation status of an outstanding derivative report after it has been updated to comply with the new requirements?

No. The reconciliation status of outstanding derivative reports should be based on the most recent reconciliation. All reports subject to reconciliation should be included in the reconciliation process, regardless of whether they have been updated to comply with the new requirements. Once a report is updated to comply with the new requirements, a new reconciliation should take place.

We are aware this approach will result in reconciliation breaks during the 6-month transition period, particularly where one counterparty reporting a trade may have updated a report to comply with the new requirements, but the other counterparty, reporting the same transaction, has not. However, we expect this to be a short-term issue during the transition period.

This will provide a more accurate view of reconciliation for Authorities.

1.5 How should counterparties reporting at position level ensure outstanding reports are updated to comply with the new requirements, and which action/event type should be used in such circumstances?

Trade level derivatives that are included in a position are not outstanding and therefore do not need to be re-reported and updated to comply with the new requirements. Only the corresponding derivative at position level needs to be updated to comply with the new requirements, provided it is outstanding on 30 September 2024.

As with other outstanding reports, outstanding position level reports should be updated to comply with the new requirements with the action type 'Modify' and event type 'Update' before the conclusion of the transition period. However, this will not be necessary where counterparties have corrected or modified an outstanding report with the action type 'Modify' or 'Correct', since doing so will require updating the report to comply with the new requirements. Counterparties must ensure that outstanding position level reports that have not been modified or corrected during the transition period, regardless of whether daily valuation and collateral updates are being reported, are updated with the action type ‘Modify’ and the event type ‘Update’ since the daily valuation and collateral updates will not include details for every field.

Counterparties should keep in mind acceptable action and event type combinations when reporting at position level. See also Section 5 Actions and Events.

1.6 Do the XML schemas for TRs to Authorities allow for the reporting of derivatives that have not been updated to comply with the new requirements?

Yes. We have provided a full suite of XML Schemas for reporting from 30 September 2024 onwards.

This includes ‘relaxed’ XML schema for the Trade State Report, Margin Derivative State Report, and Reconciliation Statistics Report. These permit TRs to submit details of all derivative reports, regardless of whether they have been updated to comply with the new requirements during the 6-month transition period. That is both those derivatives trades entered into or modified on or after 30 September 2024 that are subject to the new requirements, and those derivative trades entered into before 30 September 2024 that have not yet been updated to meet the new requirements.

Trade Activity, Margin Derivative Activity, Rejection Statistics, and Warning Statistics files must only include reports that have been updated to comply with the new requirements due to the ‘strict’ XML schemas that are in place for these files.

1.7 In reports to the Authorities, should TRs make available details of derivative reports that have and have not been updated to comply with the new requirements?

Yes. TRs should include all derivatives reported by counterparties in the reports made available to Authorities, regardless of whether they have been updated to comply with the new requirements or not, and where the relaxed schemas allow them to do so. See our response to question 1.6.

1.8 Do the XML Schemas for TRs to other TRs and reporting counterparties allow for reporting of derivatives that have not been updated to comply with the new requirements?

Yes, for certain types of reports where there is a ‘relaxed’ XML schema that can accommodate derivative reports not updated to comply with the new requirements.

Specifically, the Trade State Report, Margin Derivative State Report, and Reconciliation Statistics Report files can include updated and non-updated contracts due to the relaxed schemas for these files. That is both those derivatives trades entered into or modified on or after 30 September 2024 that are subject to the new requirements, and those derivative trades entered into before 30 September 2024 that have not yet been updated to meet the new requirements.

Trade Activity, Margin Derivative Activity, Rejection Statistics, and Warning Statistics files must only include updated reports that comply with the new requirements due to the ‘strict’ XML schemas that are in place for these files.

1.9 In reports to other TRs and reporting counterparties, should TRs make available details of derivative reports that have and have not been updated to comply with the new requirements?

Yes. TRs should include all derivative reports in the reports made available to other TRs and entities responsible for reporting, regardless of whether they have been updated to comply with the new requirements, where the type of report being shared permits this due to the ‘relaxed’ XML schemas. See our response to question 1.8.

1.10 Will the ‘relaxed’ XML schemas be available after 31 March 2025?

No. Our expectation is that from 31 March 2025, all XML schemas will be ‘strict’. That is, they will only allow reports consistent with the new requirements to be reported. See also questions 1.1 and 1.2.

1.11 Will it be possible for outstanding derivative reports to be ported during the transition period?

Yes, outstanding derivative reports can be ported during the transition period. However, from 30 September 2024, any outstanding derivative reports that require porting must have been updated to comply with the new requirements. It will not be possible to port outstanding reports that have not been updated, as the relevant XML schema will only permit the sharing of updated records which comply with the new requirements between TRs.

In the event a reporting counterparty wishes to move TR during the transition period, the reporting counterparty should ensure any outstanding derivative reports are updated to comply with the new requirements before porting to a new TR. Reporting counterparties should keep this in mind when developing and implementing plans to ensure outstanding reports comply with the new requirements as it may impact reporting arrangements, for example, where firms use delegated reporting arrangements.

2. Reconciliations

This set of Q&As relates to processes for reconciling data between TRs. TRs are required to establish procedures and policies to ensure the effective reconciliation of data between TRs, and improve data quality under the FCA’s EMIRR.

Entities responsible for reporting are also required to have arrangements in place to ensure reconciliation breaks are resolved as soon as practicably possible (see Article 10 (3) of Technical Standards on the Standards, Formats, Frequency and Methods and Arrangements for Reporting 2023).

2.1 How should reconciliations be performed for derivatives with 2 legs, such as interest rate swaps, where counterparties agree bilaterally on the sequencing of the legs?

TRs should reconcile derivatives with 2 legs by reconciling each of the legs as reported by the counterparties. In most cases, including interest rate swaps, the 2 legs of a derivatives trade are not sequenced in a particular order. Accordingly, TRs should match the two legs using the values in the Direction of Leg 1 field (Table 1, Item 18) with the opposite value, regardless of the order in which the legs were reported. This is in line with the reconciliation ‘Conditions’ detailed in the UK EMIR Validation Rules (applicable from 30 September 2024) (‘Reconciliation Information’, Column J).

2.2 How often should TRs perform reconciliations?

As set out in PS23/2, our expectation is for TRs to conduct reconciliations based on the latest reported value for each of the fields in Tables 1 and 2 of the Annex to the EMIR Technical Standards on the Standards, Formats, Frequency and Methods and Arrangements for Reporting 2023 as of the previous working day.

2.3 What information should TRs provide entities responsible for reporting to support the identification of reconciliation breaks, and in what format should information on reconciliation breaks be provided?

As set out in PS23/2, TRs are required to provide the results of the reconciliation process to entities responsible for reporting for each working day. This should allow entities responsible for reporting to easily identify and remediate reconciliation breaks.

In terms of the format in which this information should be shared, TRs shall provide the results of the reconciliation process in an XML format and a template developed in accordance with the ISO 20022 methodology (available on the FCA’s UK EMIR Reporting obligation webpage). This should include information on the fields that have not been reconciled. However, we do not oppose TRs sending reports in other formats in addition to XML. TRs may take this decision individually based on the needs and requirements of their respective client base.

2.4 How should counterparties remediate reconciliation breaks?

Entities responsible for reporting are required to have arrangements in place to ensure the remediation of reconciliation breaks as soon as practically possible. As the nature and severity of reconciliation breaks will vary, we do not intend to provide prescriptive guidance as to when and how counterparties should remediate breaks. However, the expectation is that entities responsible for reporting have arrangements to remediate reconciliation breaks that are appropriate to the nature, scale, and complexity of their business.

2.5 What are the requirements for the operational elements of inter-TR reconciliation?

TRs must comply with the rules outlined in Section 2.3 of the FCA’s EMIRR relating to inter-TR reconciliation. TRs should have the flexibility to agree, between them, the best way in which they can meet the requirements in EMIRR 2.3 from an operational perspective. As such, we do not intend to provide more prescriptive guidance for TRs in this area at this time. However, we will continue to monitor the effectiveness of the inter-TR reconciliation process to determine whether further guidance may be needed.

2.6 Can reconciliation reports differentiate between situations where a valuation has never been reported (‘missing’ valuations) and those in which a valuation has not been reported for at least 14 days (‘late’ valuations)?

No. Reconciliation reports do not distinguish between whether valuation updates are ‘missing’ or ‘late’.

However, it is possible under the Warnings XML schema to distinguish between ‘missing’ valuations and ‘late’ valuations. As part of their end-of-day response mechanisms, TRs are required under section 2.4.1 of the FCA’s EMIRR to provide reporting counterparties with the outstanding derivative reports for which no valuation information has been reported, or the valuation information that was reported is dated more than 14 calendar days from the day for which the report was generated.

2.7 Which fields are subject to reconciliation and reconciliation tolerance levels?

Details of the reportable fields that are subject to reconciliation and the applicable reconciliation tolerance levels, can be found in the UK EMIR Validation Rules (applicable from 30 September 2024) (‘Reconciliation Information’ sheet, Columns H-J).

3. Errors and omissions

Article 3 of the Technical Standards on the Minimum Details of the Data to be Reported to Trade Repositories 2023 requires reports to TRs to be complete and accurate. This set of Q&As relates to the process for how counterparties should approach any errors and/or omissions with their UK EMIR reporting.

3.1 What approach should entities responsible for reporting take when correcting errors and omissions in historic reports?

Entities with an obligation to report the details of derivative trades under Article 9 of UK EMIR are required to ensure that such details are complete, accurate and reported on time.

Entities responsible for reporting are expected to remediate all errors and omissions to their reports. This includes both live and matured trades regardless of age and any impacted position reports.

However, where remediation may be large and complex, entities responsible for reporting should engage bilaterally with the relevant Authority to agree a remediation plan that is proportionate to the complexity of the error and/or omission that requires remediation.

Where any material errors or omissions are identified, entities responsible for reporting must notify the relevant Authority as soon as practicably possible.

- CCPs should notify the Bank of England by completing the Errors and Omissions form available on its website.

- All other reporting counterparties should notify the FCA by completing the Errors and Omissions form available on its website.

Whereas completion of the form can be performed by any party, it is the responsibility of the counterparty in scope of UK EMIR Article 9 reporting requirement who should submit the notification to the relevant Authority.

3.2 What arrangements should entities responsible for reporting have in place to identify errors and omissions in their reported data?

At a minimum, we expect entities responsible for reporting to have systems and controls in place to ensure timely and complete reporting in accordance with Article 9 of UK EMIR.

In addition, entities responsible for reporting should ensure they have in place:

- effective governance to oversee their UK EMIR reporting

- effective systems and controls to identify and remediate errors and omissions (including the notification of any errors and omissions to the relevant Authority); and

- arrangements with counterparties to address reconciliation breaks

Entities responsible for reporting should assess the materiality of any errors or omissions in their UK EMIR reporting (including identification of any errors and omissions that are to be reported to the relevant Authority) based on the size, nature, and complexity of their business.

3.3 How should entities responsible for reporting use the information in the reconciliation reports they receive from TRs?

Entities responsible for reporting should use reconciliation reports received from TRs to validate the contents of their reports with their counterparties. All entities responsible for reporting should have arrangements in place with their counterparties to ensure any reconciliation breaks are appropriately resolved as soon as practicably possible.

The severity and drivers of reconciliation breaks will differ. As such, more prescriptive timelines within which entities should remediate breaks would not be appropriate for the remediation of certain reconciliation breaks.

3.4 What is the status of reports included in the Warnings Feedback message provided by TRs? How should entities responsible for reporting use the Warnings Feedback message?

The Warnings Feedback message provided by TRs to entities responsible for reporting is to identify missing data and potential outlier values without rejecting the reports, and to help reporting counterparties identify and remediate possible errors and omissions within reported data. The reports included within the Warnings Feedback message have been accepted by the TR which is reflected in its status (Acknowledged or ACK).

Entities responsible for reporting should use the information provided in the Warnings Feedback message to monitor the accuracy of their reporting by investigating the potential issues. They should then confirm if remediation is required to correct any errors or omissions without undue delay to comply with Article 9 UK EMIR, including by submitting an Errors and Omissions form on the appropriate Authority’s website where necessary.

3.5 What are the thresholds used to identify outlier values?

In accordance with the provisions of Section 2.4 of the FCA’s EMIRR, TRs will be required to notify entities responsible for reporting of any reports where the notional amount exceeds a threshold for that class of derivative as part of the Warning Feedback message. The intention of having thresholds to identify outlier values is to identify possible erroneous reporting of notional amounts in a particular asset class that would materially affect the Authorities' view of the largest exposures in a particular asset class.

To achieve this outcome, the Authorities propose to co-ordinate with UK TRs to implement a set of thresholds to make the Warnings Feedback message a useful and consistent data quality metric for both industry and the Authorities. We will request that TRs make these thresholds available to clients in an easily accessible manner once they have been established.

The Authorities will continue to monitor the introduction of the Warnings Feedback message, including the ongoing effectiveness of the thresholds set.

3.6 How should derivatives reported under the old requirements, and subsequently need to be revived, be reported?

Where a reporting counterparty uses the Revive action type to reopen a report that has not been updated to comply with the new requirements, for example to correct errors in matured trades, the reporting counterparty should provide all relevant details to update the report to comply with the requirements as of the date of the revival action. This is the same approach as for any revived report.

Counterparties are expected to provide all the relevant data to update revived reports so they comply with the new requirements. But if this is not possible, counterparties are expected to proactively engage with us, with an explanation and a proposed solution.

4. Derivative identifiers

Amendments to the UK EMIR reporting framework introduces new requirements for the use of Unique Product Identifiers (UPIs) and updated requirements relating to Unique Transaction Identifiers (UTIs) and Legal Entity Identifiers (LEIs). This set of Q&As gives further guidance on how these identifiers should be reported.

4.1 Should pre-existing UTIs be modified?

No. In line with the UK EMIR Validation Rules (applicable from 30 September 2024), UTIs should not be amended once they have been reported.

As set out in CP21/31, we are not expecting the generation of new UTIs for outstanding trades and positions and the UK EMIR Validation Rules (applicable from 30 September 2024) permit the use of old format UTIs to reflect this. UTIs allocated to a trade or position should remain the same throughout the lifetime of the trade or position and a new UTI should be used only if a trade or position is replaced by one or more trades or positions, for example following a post trade risk reduction (PTRR) event. Therefore, TRs should reject any modifications to pre-existing UTIs.

4.2 How should UTIs be treated when they are generated by non-UK counterparties under different reporting requirements?

The updated UTI structure in UK EMIR is based on CPMI-IOSCO Technical Guidance on the Harmonisation of the Unique Transaction Identifier. UTIs generated by non-UK counterparties pursuant to a different reporting regime should align with the formatting requirements under UK EMIR, meaning they can be treated in the same manner as UTIs generated under UK EMIR.

Noting there may be differences in implementation timelines for the updated UTI structure between jurisdictions which may present issues, we will monitor progress and consider if further guidance is necessary.

4.3 Should UTIs generated by trading venues incorporate the existing trading venue transaction identification code (TVTIC) as reported under UK MiFIR?

There is no requirement for UTIs generated by trading venues to incorporate the trading venue’s TVTIC into the UTI. In line with Article 8 of the Technical Standards on the Standards, Formats, Frequency and Methods and Arrangements for Reporting 2023, UTIs must be composed of the LEI for the counterparty who generated the UTI, followed by a code of up to 32 characters which should be unique at the level of the generating entity.

While a trading venue’s TVTIC can’t be used in place of a UTI, there is nothing to prevent trading venues from incorporating an existing TVTIC into the UTIs it generates, provided the UTIs continue to meet the requirements in Article 8 of the Technical Standards on the Standards, Formats, Frequency and Methods and Arrangements for Reporting 2023.

4.4 When should International Securities Identification Numbers (ISINs), UPIs and Classification of Financial Instrument (CFI) codes be used in combination?

Article 7 of the Technical Standards on the Standards, Formats, Frequency and Methods and Arrangements for Reporting 2023, requires derivatives to be identified with an ISIN where the derivative is either:

- admitted to trading or traded on a trading venue; or

- traded on a systematic internaliser (SI) and the underlying is admitted to trading or traded on a trading venue or an index or basket composed of instruments traded on a trading venue

Where a derivative does not meet one of these conditions it should be identified with a UPI, regardless of whether the derivative has an ISIN. Accordingly, ISINs and UPIs should not be used in combination, and the UK EMIR Validation Rules (applicable from 30 September 2024) will not permit the reporting of a UPI where an ISIN is provided.

CFI codes should be provided where possible for all derivatives in addition to an ISIN or UPI, depending on whether it is admitted to trading or traded on a trading venue or SI.

4.5 What should be used if an ISIN does not exist for a derivative traded on a third country organised trading platform?

A product identifier is not required to be reported for derivatives executed on a third country organised trading platform if neither an ISIN nor a UPI exist.

4.6 Should fields which overlap with UPI reference data be reported?

Yes. Entities responsible for reporting must report all the applicable fields specified in the Technical Standards on the Minimum Details of the Data to be Reported to Trade Repositories 2023, including those which overlap with UPI reference data.

However, we will continue to monitor the implementation of the UPI system under the UK regime and will communicate any developments accordingly.

4.7 Are TRs required to enrich reports with data derived from the UPI database?

No. TRs are not required to enrich reports as entities responsible for reporting must continue to report fields which overlap with UPI reference data.

However, we will continue to monitor the implementation of the UPI system under the UK regime and will communicate any developments accordingly.

4.8 Are entities responsible for reporting required to ensure the LEI of their counterparty has not lapsed?

No, except in the case of mandatory delegated reporting.

Article 4 of the Technical Standards on the Standards, Formats, Frequency and Methods and Arrangements for Reporting 2023, requires entities responsible for reporting to ensure the reference data related to their LEI is renewed in accordance with the terms of any of the accredited Local Operating Units of the Global LEI System.

For mandatory delegated reporting, the non-financial counterparty (NFC) is responsible for renewing and maintaining its LEI, as explained in PS23/2. But as required under Article 10 of the Technical Standards on the Standards, Formats, Frequency and Methods and Arrangements for Reporting 2023, financial counterparties must have in place arrangements for due renewals by the NFC of its LEI to ensure accurate reporting for which the FC is solely responsible and legally liable.

Accordingly, the UK EMIR Validation Rules (applicable from 30 September 2024) require the LEI status of Counterparty 1 (Table 1, Item 4) and the Entity responsible for reporting (Table 1, Item 3) to be Issued, Pending transfer or Pending archival for certain action types. However, for Counterparty 2 (Table 1, Item 9) the LEI status may be Lapsed for certain action types. The Validation Rules provide further details as to what LEI status is required for the different action types.

4.9 Should TRs validate LEIs against the Global LEI Foundation (GLEIF) database based on the Reporting Timestamp field (Table 1, Item 1)?

Yes. TRs should, where applicable, validate LEIs against the GLEIF database as of the date reported in the Reporting Timestamp field.

5. Actions and Events

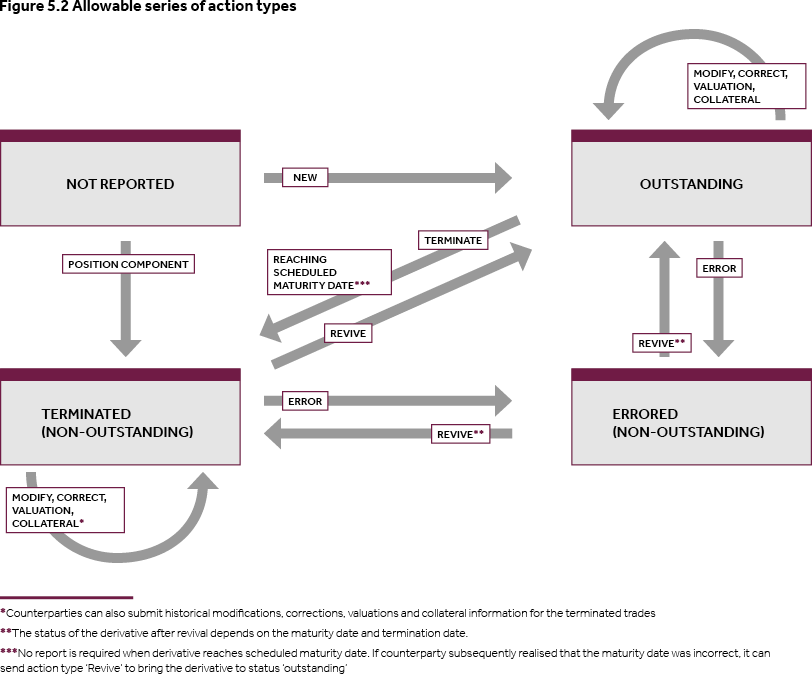

The combination of Action Type and Event Type clarifies the reasons why a report is made (eg a new trade, an early termination, a modification due to a step-in event). The new requirements introduce a new action type, 'Revive', which can be used when re-opening a derivative at trade or position level. This set of Q&As provides further guidance on how action types and events should be reported consistently.

5.1 Does the new Event Date field (Table 2, Item 153) impact how TRs should validate reports depending on action type?

Yes. The new Event Date field will impact TR validation of reports, dependent on which action type is reported.

For details on how the Event Date is limited depending on action type, see the UK EMIR Validation Rules (applicable from 30 September 2024) where we detail our expectations in the 'Trade validations auth.030' sheet in Table 2, Item 153 Validation Rules.

5.2 How does the new Event Date field (Table 2, Item 153) affect how TRs validate records?

The Event Date field affects several TR validation steps. Primarily, it is used in conjunction with the Reporting Timestamp field (Table 1, Item 1) to validate the order of incoming submissions. The Event Date field is also used to determine whether the LEI status of various parties to a trade needs to be validated and, in instances where the Valuation Timestamp (Table 2, Item 23) field is populated, it should match the Event Date field.

For full details on how the Event Date field restricts other fields, see the UK EMIR Validation Rules (applicable from 30 September 2024) where we detail our expectations in the 'Trade validations auth.030' sheet and the 'Margins validations auth.108' sheet.

5.3 What should be reported when a transaction that has been included in a position is identified as incorrect?

In this scenario, correction reports should be submitted for both the original (terminated) transaction and any impacted position reports. The transaction should not be revived.

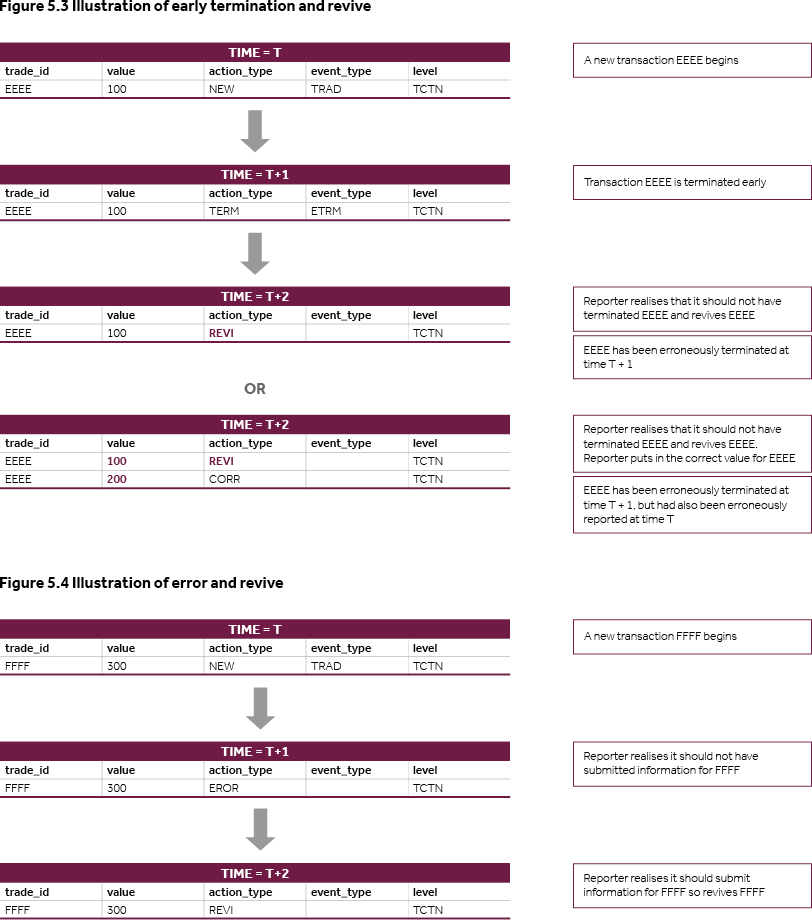

Figure 5.1 illustrates a scenario where a transaction is reported incorrectly and subsequently compressed into a position.

5.4 How can action type be used to get the latest state of a derivative trade?

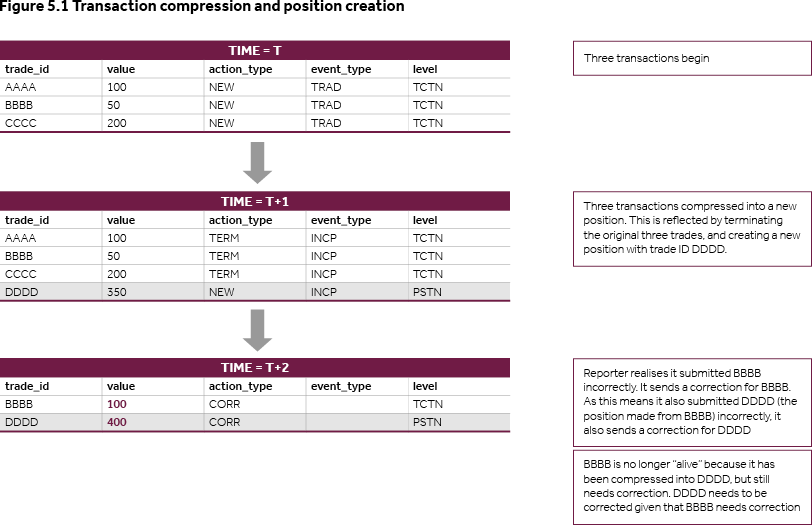

There are 4 states (Not reported, Outstanding, Terminated and Errored). The state of a derivative contract resulting from an action depends on the latest action and the previous state.

Figure 5.2 illustrates how the action type and the previous state determine the current state of a derivative contract.

This diagram has been drafted using material downloaded from the European Securities and Markets Authority’s (ESMA's) website. ESMA does not endorse this publication and is in no way liable for copyright or other intellectual property rights infringements, nor for any damages caused to third parties through this publication.

5.6 What are the possible combinations of action and event type?

The possible combinations of action and event type, and when they can be used, are described in Table 5.1 below.

Table 5.1 Applicability of Action type – Event type combinations

| Action type | Event type | Applicability | Comments |

|---|---|---|---|

| New | Trade |

When a derivative with a new UTI is created for the first time through a trade, and not because of another prior event. |

Combination ‘New’-‘Clearing’ should be used for the new derivatives resulting from clearing, in particular for derivatives traded on trading venues and cleared on the same day by a CCP. |

| New | Step-in |

When a derivative or position with a new UTI is created for the first time due to a step-in event. |

|

| New | PTRR | When a derivative with a new UTI is created for the first time due to a PTRR event. |

Combination ‘New’-‘PTRR’ at position level is not applicable, as any derivative newly created due to a PTRR event is expected to be reported at trade level (without prejudice to the possibility of including such derivative subsequently in a position). Combination ‘New’-‘PTRR’ can be used in case of rebalancing. |

| New | Clearing | When a derivative with a new UTI is created for the first time due to a Clearing event. | This combination also includes a clearing of OTC derivatives which were previously bilaterally agreed among counterparties and subsequently cleared. |

| New | Exercise | When a derivative with a new UTI is created for the first time due to an Exercise event. | This combination should be used when reporting the underlying swap following the execution of a swaption. |

| New | Allocation | When a derivative with a new UTI is created for the first time due to an Allocation event. | |

| New | Inclusion in position | When a new position is created by inclusion of trades in that position for the first time. | |

| New |

Corporate Event |

When a derivative or position with a new UTI is created for the first time due to a corporate action on the underlying equity. | |

| Modify | Trade | When a derivative or position with an existing UTI is modified due to renegotiation of the terms of the trade, because of the changes to the terms of the trade agreed upfront in the contract (except for when such changes are already reported eg notional schedule) or because previously not available data elements become available. | |

| Modify | Step-in | When a derivative or position with an existing UTI is modified due to a Step-in event. |

This combination includes also a transfer of a derivative at trade or position level from one CCP to another. |

| Modify | PTRR | When a derivative or position with an existing UTI is modified due to a PTRR event. |

Combination ‘Modify’-‘PTRR’ at position level should only be used in the case where CCP positions are subject to PTRR (rather than bilateral netting and subsequent reporting at position level). Combination ‘Modify’-‘PTRR’ can be used in the case of compression. |

| Modify | Early termination | When a derivative or position with an existing UTI is modified due to an early termination agreed in advance or due to a partial termination. | In the case of an early termination agreed in advance, the counterparties should update the maturity date. In the case of partial early termination, the counterparties should update the notional. |

| Modify | Exercise | When a derivative or position, is amended due to the exercise of an option or swaption. | |

| Modify | Allocation |

When a derivative with an existing UTI is partially allocated. This is used to report the amended notional of the existing derivative. |

|

| Modify | Credit event | When a derivative or position with an existing UTI is modified due to a Credit event. | |

| Modify | Inclusion in position | When a position with an existing UTI is modified because of inclusion of a new trade. | |

| Modify |

Corporate Event |

When a derivative or position with an existing UTI is modified due to a corporate action on the underlying equity. | |

| Modify | Update | When a derivative or position that is outstanding on the reporting start date is updated in order to conform with the amended reporting requirements. | |

| Modify | No event type required | When a position with an existing UTI is modified due to more than one type of business events that occurred intraday. | Intraday reporting is not mandatory for ETDs, consequently counterparties are allowed to report ‘Modify’ at position level without indicating the event type, where such modification is a result of more than one type of business events that occurred intraday. |

| Correct | No event type required | When a derivative or position with an existing UTI, or the data related to the collateral, is corrected because of an earlier submission of incorrect information. | |

| Terminate | Step-in | When a derivative or position with an existing UTI is terminated due to a step-in event. This is used for terminating the old UTI post step-in. | |

| Terminate | PTRR |

When a derivative or position with an existing UTI is terminated due to a PTRR event. This is used for terminating the old UTI(s) after PTRR operation. |

Combination ‘Modify’-‘PTRR’ can be used in the case of compression. |

| Terminate | Early termination | When a derivative or position with an existing UTI is terminated due to an early termination (and when no other cause/event is known as the reason for that termination). | |

| Terminate | Clearing | When a derivative with an existing UTI is terminated due to a Clearing event. This is used for terminating alpha trades. |

In the case of OTC derivatives concluded bilaterally, counterparties need to terminate the previously reported bilateral trades (with combination ‘Terminate’-‘Clearing’) and report the new cleared trades (with combination ‘New’-‘Clearing’). This also includes a scenario where existing derivatives become eligible for clearing at a later stage. |

| Terminate | Exercise | When a derivative with an existing UTI is terminated due to an exercise event. For example, this is used for terminating options/swaptions when these are being exercised. |

‘Terminate’-‘Exercise’ should not be reported when the option is exercised on the maturity date. More generally, only terminations that take place at a date prior to the maturity date should be reported. |

| Terminate | Allocation | When a derivative with an existing UTI is terminated due to an allocation event. This is used for terminating the old UTI post allocation. | |

| Terminate | Credit event | When a derivative or position with an existing UTI is terminated due to a Credit event. | This combination should be reported when a Credit event leads to termination and settlement of the derivatives, eg single name CDS. |

| Terminate | Inclusion in position | When a derivative or position with an existing UTI is terminated due to inclusion in a position. | A derivative at trade level that is immediately included into a position, should be reported with action type ‘Position component’. Only when a derivative is included in the position after being reported with action type ‘New’, it should be reported with action type ‘Terminate’ and event type ‘Inclusion in position’. |

| Terminate |

Corporate Event |

When a derivative or position with an existing UTI is terminated due to a corporate action on the underlying equity. | |

| Error | No event type required | When a derivative or position with an existing UTI is cancelled due to an earlier submission of incorrect information. For example, this is used to cancel the UTI of a derivative or position that should not have been reported (eg it is not a derivative transaction) or to cancel outstanding derivatives when the counterparty starts to benefit from an intragroup exemption. | |

| Revive | No event type required |

When a derivative or position that has been cancelled is reinstated due to an earlier submission of incorrect information. For example, this is used to reinstate the UTI of a derivative or position that has been erroneously terminated. |

This action type should not be used to reopen a position that was previously netted and terminated. ‘Revive’ should only be used to reopen the trades that were terminated or cancelled by mistake or which were cancelled due to IGT exemption, so that the counterparties do not need to regenerate a new UTI. It should not be used for other reporting scenarios. In particular in the case of netted position, the counterparties need to decide if they maintain the position open (and report the valuation accordingly) or they close the position. If the counterparties close the position and then they enter into another derivative contract of the same type, and want to report at position level, they need to report a new position with a new UTI. |

| Valuation |

No event type required |

When data related to the valuation are submitted for a derivative or position with an existing UTI. | |

| Margin update |

No event type required |

When data related to the collateral are submitted for a derivative or position with an existing UTI. | |

| Position component |

No event type required |

When a new derivative is concluded and included in a position on the same day. |

This table has been drafted using material downloaded from the European Securities and Markets Authority (ESMA’s) website. ESMA does not endorse this publication and is in no way liable for copyright or other intellectual property rights infringements, nor for any damages caused to third parties through this publication.