The Financial Conduct Authority (FCA), Financial Ombudsman Service (FOS) and Financial Services Compensation Scheme (FSCS) report on our joint action to help former British Steel Pension Scheme (BSPS) members get the retirement they worked for.

1. Introduction

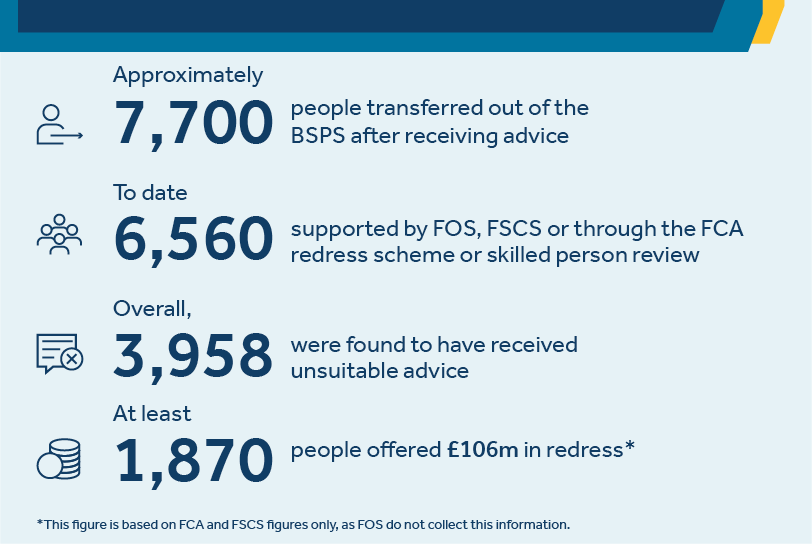

When the BSPS was restructured in 2017, around 7,700 members decided to transfer out of the scheme after receiving advice.

The FCA estimates almost half (46%) of this advice was unsuitable. This poor conduct by some advisers caused significant harm and distress.

'When I spoke to the advisor...I thought he took advantage of my fears.'

'Knowing what I know now, I'm in two minds whether I made the right decision. Sleepless nights, I'm not cut out for dealing with these finances.'

'I was only a steelworker with no idea what I should of been doing with regards to my pension.'

Former BSPS members, FCA survey, February 2021

The FCA, FOS and FSCS have been closely working together to make sure that:

- every former BSPS member has had the opportunity to find out whether their advice was suitable

- former members that lost out because of unsuitable advice are, as far as is possible, put back in the financial position they would have been in had they stayed in the BSPS

- advisers who caused serious harm are held accountable for their poor conduct

2. Our approach to suitability and redress

Helping former BSPS members to complain

Since January 2018 we encouraged former BSPS members to complain to their adviser if they felt they may have received unsuitable advice.

If they were unhappy with their adviser’s response, they could complain to the FOS.

If the firm had gone out of business, former members were encouraged to make a claim with FSCS.

To help former members understand what they needed to do, we provided a range of support. This included:

- writing directly to them in 2018, 2019 and 2020

- running local events with them in 2019 and 2021 (also joined by the Money and Pension Service)

- communicating through their trusted intermediaries (including steelworkers, MPs and trade unions)

- providing tools, such as our advice checker, to make it easier to understand if their advice was suitable

Introducing a redress scheme

By 2021, despite our outreach, many former BSPS members had not yet complained.

FCA research identified that many were unlikely to complain, with common barriers including:

- not knowing if their advice had been unsuitable

- feeling uncomfortable complaining to their adviser

So, recognising the exceptional levels of unsuitable BSPS advice and to make sure all former members got the opportunity to have their advice reviewed, in 2022 the FCA confirmed it was introducing a redress scheme.

Former BSPS member, FCA survey, February 2021

Under the redress scheme, firms had to:

- review the advice they gave

- pay redress to those who lost money because of unsuitable advice

The timeline below summarises the key scheme steps.

Summary of scheme steps

Identify scheme cases by 28 March 2023

Review the suitability of the advice by 28 September 2023

Calculate redress if the advice was unsuitable

Cash lump sum payments offers made by 28 December 2023

Offers to make payments into pensions by 28 February 2024

The FCA:

- supervised firms closely and put checks in place to make sure firms carried out the scheme steps properly

- provided tools for firms to use to check the suitability of their advice and to calculate redress

Firms also had to give the FCA details of cases they rated as suitable, so it could check if former BSPS members would like the FOS to independently review their advice.

Before the scheme started, the FCA made emergency rules to stop firms stripping assets to avoid paying redress. The FCA also acted against firms making unsolicited offers in an attempt to exclude former BSPS members from the scheme and reduce their potential redress liabilities.

In the run-up to, and during, the scheme we regularly engaged with former BSPS members to help them understand what it meant for them. We wrote to all former BSPS members about the introduction of the scheme. Since 2022, we, along with the Money and Pensions Service, have hosted 25 in-person events (including 3 virtual sessions) in Wales and North East England, reaching over 1,200 former BSPS members.

3. Suitability and redress outcomes

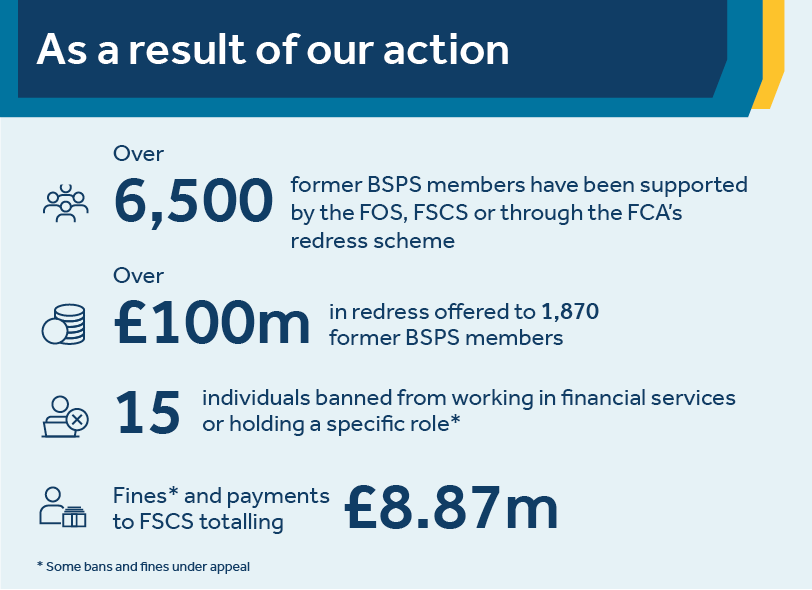

In total, over 6,500 former BSPS members have been supported by the FOS, FSCS or through the FCA’s redress scheme.

More than £100m in redress has now been offered to at least 1,870 former BSPS members.

*The FOS figure is from 3 FCA surveys in February 2022 which requested information from firms about redress paid following FOS decisions. It likely under-estimates redress paid.

*Numbers don’t sum due to rounding.

We estimate 1,744 former members received unsuitable advice but were not offered a redress payment. This is because, even though they received unsuitable advice, they haven't lost out financially as a result.

Since 2022, due to changing economic conditions, the proportion of individuals who received unsuitable advice to transfer but didn't receive a redress payment has increased significantly.

Read more about this in section 4.

These figures do not account for all the estimated 7,700 steelworkers who transferred out of the BSPS after receiving advice. This is mainly because where a firm fails, customers need to make a claim to FSCS. Despite significant outreach, we know some individuals have not yet made a claim.

If your adviser has gone out of business, you should claim with FSCS.

There are also still over 200 claims working their way through the redress scheme.

3.1. Redress outcomes pre-redress scheme

Skilled person review

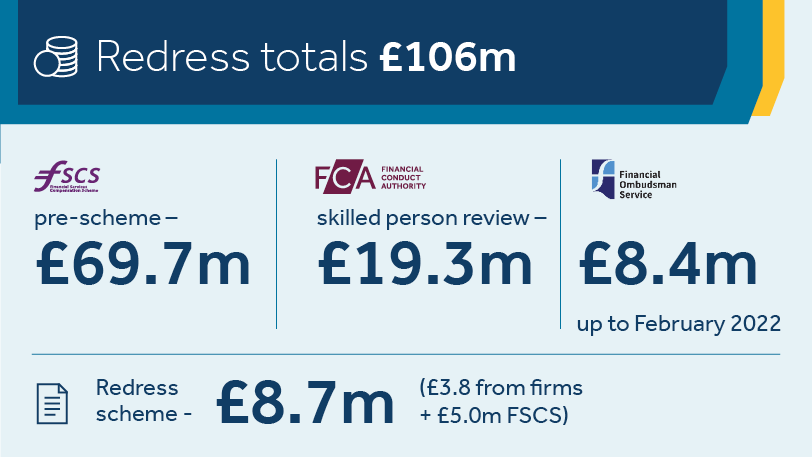

262 customers had their advice reviewed by an independent expert (‘skilled person’):

- 166 were assessed as unsuitable

- 119 were offered redress totalling £19.3m

- the remaining 47 had received unsuitable advice but were not owed any redress as they were no worse off financially as a result

FOS complaints

The FOS received just under 1,500 complaints from former British Steel workers before the scheme started. Of these, 455 cases were referred to FSCS, and a small number fell outside of the FOS’s jurisdiction. Of the remainder, 86% of cases were upheld in the consumer's favour.

The total amount paid to consumers was at least £8.4m. This figure is based on information collected from firms and covers the period up to February 2022 and so is an underestimate.

‘I was dealt with very professionally and speedily, it put to rest that my complaint was addressed with the company I queried correctly and that I had no further grounds for a complaint.’

‘[Case Handler] who dealt with my case was fantastic in all aspects whether it be explanation, communication or direction and again many thanks for his endeavours on my behalf.’

‘Although the outcome was not beneficial to myself I thought the investigation was thorough and well communicated.’

Feedback from FOS complainants

FSCS claims

1,768 former BSPS members made a claim with FSCS before the scheme started. Of those, 1,257 were upheld with redress totalling £69.7m, 302 claimants were found to have received unsuitable advice but were not owed any redress as they were no worse off financially as a result.

‘I felt the service was open and honest. Staff were very helpful and recognised the issues I had encountered.’

‘The whole process was simple. I was kept informed throughout and treated with the utmost respect by the staff. From beginning to end it was a great experience.’

‘I was very daunted when I first contacted FSCS, however they were very patient when I explained that I wasn't very good with spoken words but could understand written words much easier, so they said it would be no problem to progress with emails.’

Feedback from FSCS complainants

3.2. Redress scheme outcomes

A note on the data

These figures are based on data reported to the FCA by firms and combined with data held by FOS and FSCS.

Due to the way this data is reported by firms, the figures in this report reflect the position as at the end of April 2024. At this point, the vast majority of consumers had completed the scheme. As explained below a small number are still progressing through the scheme.

Assessment of advice

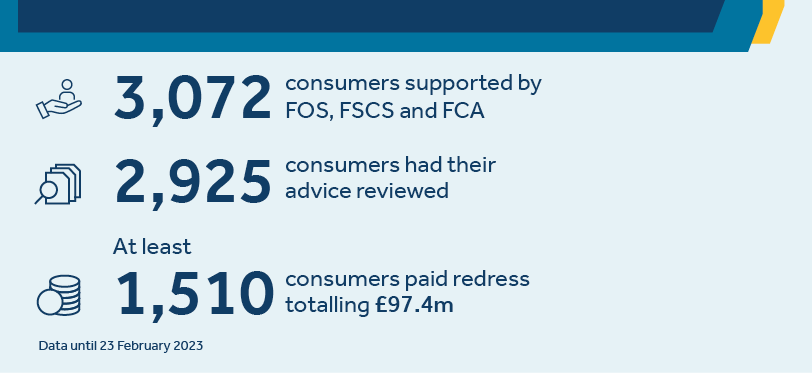

Firms assessed 49% of advice to be unsuitable. This broadly aligns with the FCA’s estimate before the scheme started.

Firms reported that:

- 1,073 people (49.1%) had their advice assessed as suitable

- 1,079 people (49.4%) had their advice assessed as unsuitable

- in 34 cases (1.6%) there was missing information, which prevented the firm from making an assessment

For the 34 cases with missing information, under the scheme rules, firms had to seek this information from their customers through 2 follow-up attempts. If the customer did not provide it, the firm sent a final letter explaining the customer's right to complain to the FOS and that, due to the missing information, the firm could no longer review their advice under the scheme.

Calculation and payment of redress

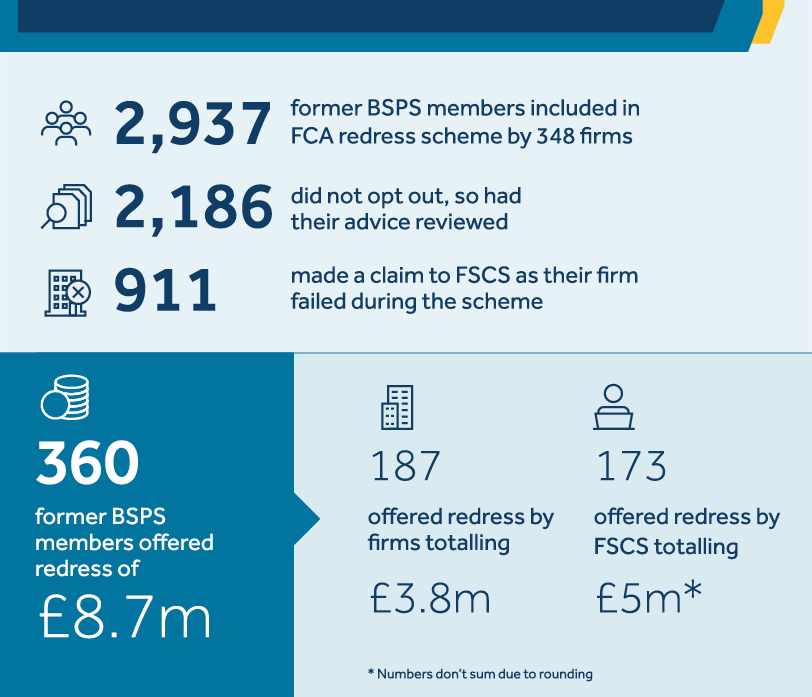

Under the scheme, 360 former BSPS members were offered redress of £8.7m. 187 people were offered redress by firms totalling £3.8m and a further 173 offered redress by FSCS totalling £5m (figure rounded).

As of 28 April 2024, 32 redress calculations (27 scheme and 5 pre-scheme) are awaiting an FOS decision.

As of 24 April 2024, the FSCS is still to process 217 claims, made up of 138 scheme and 79 pre-scheme claims. FSCS is still accepting new BSPS claims so this number is expected to rise.

‘No loss' cases

The percentage of unsuitable cases where it was determined that former members were due no redress is 70.1%. This figure combines no-loss cases reported by firms and those from FSCS.

This is significantly higher than expected when the FCA implemented the scheme. As we outline further in this report, this is consistent with the shifts seen in general redress values due to changing economic conditions.

Ensuring firms carried out the scheme properly

The FCA’s rules for the scheme set out the steps that firms must take at all stages, including making sure former members knew they could complain to the FOS at any stage if they were unhappy with the outcome the firm reached.

As of 28 April 2024, the FOS had received 371 complaints during the scheme, with 344 cases resolved. 55% were upheld in the consumer’s favour.

The FCA also closely scrutinised firms going through the redress scheme. Where firms determined the advice they gave was suitable, they had to give the FCA the consumer’s contact details. The FCA contacted these consumers to remind them of their right to refer their case to the FOS for an independent review. Overall, 179 consumers whose firm said they received suitable advice then complained to FOS.

After making a complaint to the firm which advised him to transfer his pension, British Steel worker Mr S was told by the firm the advice they had given was suitable.

Mr S disagreed and referred his complaint to the FOS. An investigator considered the business’ final response to Mr S alongside the redress scheme rules and found that it hadn’t applied the rules correctly.

The investigator asked the business to calculate any redress due and to pay it to Mr S, which the business agreed to do.

FOS complainant

Where firms reported a high proportion of former members who opted out of the scheme, the FCA contacted them to ensure firms were not pressuring them to opt out and reminded them of their right to refer their case to the FOS for an independent review. Overall, 39 consumers who opted out of the scheme complained to FOS.

‘I queried with the adviser what the BSPS redress scheme was, I was told I would receive zero and felt pressured and rushed to tick the box and send the form back. I didn’t fully understand it and I wouldn't sign away any compensation.’

Former BSPS member contacted by the FCA

Proactive communication with consumers of failed firms

We encouraged customers of firms that went out of business during the redress scheme to make a claim with FSCS. Since the start of the scheme, 11 firms became insolvent.

Where the firm held good client records, including up-to-date contact details, FSCS was able to proactively contact former BSPS members who had received advice from the firm. They were invited to make a claim and supported through the process over the phone or through webchat if needed.

To date, FSCS has been able to proactively contact customers of 7 firms that failed. Each customer was sent a direct letter from FSCS, followed up with further communications if they hadn’t responded.

Inspirational Financial Management Ltd

FSCS has not yet been able to contact customers of Inspirational Financial Management Ltd.

If you're a customer and have not yet had advice reviewed, you should make a claim with FSCS to find out if you're owed compensation.

4. Changes in redress values

A key aim of our work is to make sure that steelworkers who received poor advice to transfer out of the BSPS do not lose out as a result.

To work out if former BSPS members are owed money, firms must calculate how much is needed in the consumer’s defined contribution (DC) pot to match the pension they would have received had they not transferred out of their defined benefit scheme. Firms must then compare that with the current value of their DC pot. The calculations are based on what financial markets expect to happen in the future. The redress calculation assumes that consumers will aim to get the same amount in pension benefits they had given up, by buying an annuity. An annuity provides a guaranteed income for life.

Since the FCA introduced the redress scheme, the expected cost of funding a guaranteed retirement income through an annuity has fallen. For example, it now costs less to achieve the same guaranteed retirement income as someone who received redress 2 years ago. This means that the amount needed to top up a DC pot to put someone back in the position they would have been in if they hadn’t received unsuitable advice, is likely to be less and in some cases zero.

If a former BSPS member has more in their DC pot than the value of the benefits they would have had if they had stayed in the BSPS, then they won’t be offered any money following a redress calculation. This is because even though they received unsuitable advice, they haven't lost out as a result.

We understand former BSPS members may be disappointed to receive no money or less than expected. The purpose of redress calculations is to ensure that, as far as possible, former members are put back in the financial position they would have been in had they remained in the BSPS.

This is comparable to the approach a court would likely take to calculating damages in similar cases.

We have included examples below of BSPS complaints and claims considered by the FOS and FSCS to show how redress awards can vary depending on individual circumstances.

5. Action taken against firms and individuals

The FCA has carried out around 30 enforcement investigations into BSPS transfer advice.

So far, this has resulted in:

- 15 individuals being banned from working in financial services or holding a specific role

- firms or individuals being required to pay fines or make payments to FSCS totalling £8.87m

(Some of the bans and fines are being appealed.)

Where appropriate, rather than imposing financial penalties, the FCA has sought payments to be made to FSCS, ensuring those responsible for the wrongdoing contribute towards redress paid by FSCS to consumers who lost out financially because of unsuitable advice.

The FCA continues to pursue those who gave poor advice and publishes updates on its BSPS enforcement page.