This report sets out our review findings of relending by firms in the high-cost lenders portfolio.

Why we conducted this review

Our Portfolio Strategy letter issued in March 2019 set out our view of the key risks that firms within the high-cost lenders portfolio pose to their customers or the markets they operate in. We identified one of the key ways consumers may be harmed was by the high volume of relending, which may be symptomatic of unsustainable lending patterns.

What we did

We prioritised diagnostic work so we could better understand the motivation for, and impact of, relending on both consumers and firms. We examined aspects of relending such as customers’ borrowing journeys, firms’ marketing strategies for offering additional credit and the costs of relending to consumers. We analysed data from firms across the high-cost lenders portfolio, as well as conducting consumer research to better understand customers’ perspectives.

Who this applies to

In this review, we set out our findings and the actions we expect firms to take and applies to high-cost lender portfolio firms offering the following products:

- guarantor loans

- high-cost short-term credit (HCSTC)

- high-cost unsecured loans aimed at subprime customers

- home-collected credit (HCC)

- logbook loans

- rent-to-own (RTO)

Firms offering pawnbroking, income smoothing products and community development finance institutions (CDFIs) were not included in the review. But the messages here may be useful and these firms should read this review in full.

Next steps

We expect firms to review their relending operations in the light of our findings and make any necessary changes to improve customer outcomes.

Findings

Relending and customer outcomes

Firms should ensure that relending leads to positive customer outcomes and does not cause harm

Our analysis of data provided by firms and our consumer research shows breaches of specific rules as well as breaches of our principles for business. In this report, we set out what we have found, our expectations and examples of what firms can do to meet these principles.

From developments in the market, including trends in Financial Ombudsman Service complaints and a number of high-cost short-term credit (HCSTC) firms entering administration as a result of liabilities for complaints, we can see the consequences for firms that fail to adequately assess affordability or relend in a way that is sustainable for their customers.

Across the portfolio, we have seen levels of debt increasing as customers take additional loans. We did not generally observe additional credit being used to maintain existing levels of debt. Some customers told us they have experienced financial difficulties caused by relending and related anxiety and stress. Many regret their additional borrowing and the consequent financial position they find themselves in.

I was borrowing from Peter to pay Paul, and robbing Paul to pay someone else.

Male, 47, Glasgow

When I started, I would take £100 at the beginning of the month and another £100 later in the month. Then I started taking out £500 at the beginning of the month. Then I began to take out loans to pay my other loans, and just to get by.

Male, 32, Sheffield

I started missing payments and hit a really bad period when I was struggling to pay back my existing payday loans meant I had to take out new ones to cover the previous ones. I became so depressed I couldn’t leave the house.

Female, 47, Belfast

It’s a feeling of helplessness. It’s awful. You don’t sleep, you worry. You feel guilty about not being in a better position to support your family and about having made poor decisions in your life.

Female, 54, Peterborough

High-cost credit customers are more likely to be vulnerable, have low financial resilience and poor credit histories. They often hold multiple credit products and have to juggle repayments, sometimes having to decide which priority debts to pay when they don’t have enough for all. We have significant concerns that repeat borrowing could be a strong indicator of a pattern of dependency on high-cost credit and levels of debt that are harmful to the customer.

We therefore expect firms not to encourage refinancing of credit agreements where the customer’s commitments are not sustainable. We also expect firms to only agree to refinance if they reasonably believe that it is not against the customer's best interests to do so.

From our analysis, we have seen that this is not always the case and we set out our views of the potential drivers of harm and request that firms assess their relending operations to ensure they remain appropriate and consistent with our principles.

Customers have also told us they rely on credit and, despite wanting to be in a better financial position, they are used to living in debt and expect to need to continue to borrow in the future. We have seen firms servicing customers’ needs by providing additional borrowing. But we are concerned that relending can move from a positive customer experience into one which causes harm.

For all high-cost lending business models in our sample, relending is a significant part of their business. Many firms, particularly those offering small value loans, do not make a profit on a customer’s first loan. Profitability in high-cost lending firms is therefore mainly driven by relending. For nearly all firms, profitability increases for subsequent loans, in many cases substantially.

Increasing levels of debt and repayments

The level of debt and repayments can increase significantly, to the point where it is no longer affordable or sustainable for some customers

We reviewed a sample of the borrowing history of around 250,000 customers to better understand the customer journey with each firm in our sample. We saw that relending caused both the level of debt and repayment amount to increase nearly every time further borrowing was taken.

We remind firms of our Dear CEO letter from October 2018, sent to all HCSTC firms (but which equally applies to other firms in the high-cost lenders portfolio). In that, we highlighted the risks in relation to repeat borrowing given that it could indicate a pattern of dependency on credit that is harmful to the borrower. Rigorous affordability assessments are key to avoiding harm in this area, and firms should ensure they are making proportionate and responsible assessments of the sustainability of borrowing. Further, firms must not encourage a customer to refinance a regulated credit agreement if the result would be the customer's commitments are not sustainable.

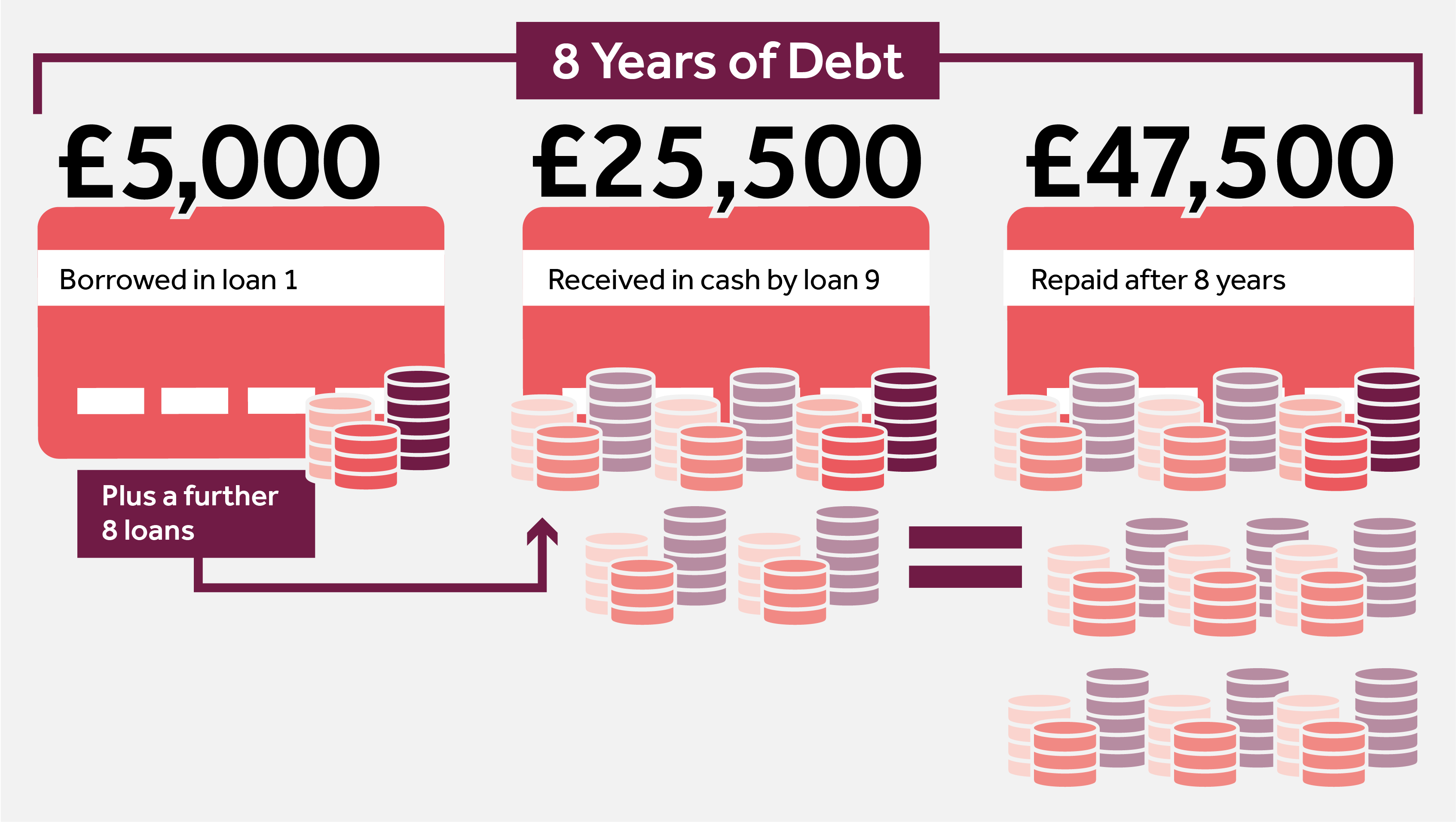

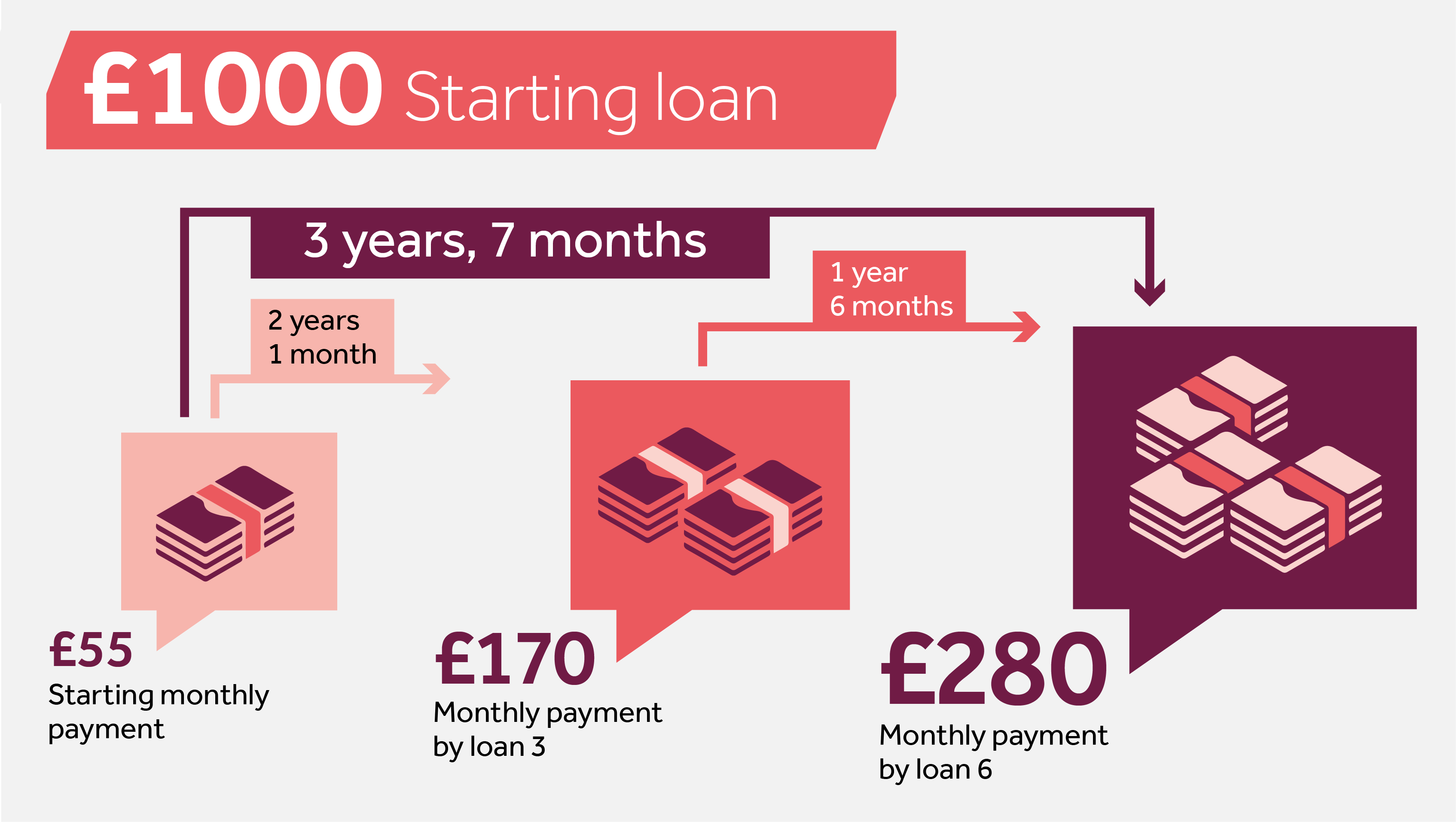

We are concerned in some instances to see levels of debt and repayments increase significantly. We saw levels of relending often double within a 2 to 3 year period. Figures 1 and 2 show how a typical customer’s overall debt and repayments can escalate to considerable levels.

Figure 1: Cash received and repayments made on 9 loans taken over an 8-year period

Figure 2: Increase in monthly repayments

At some point, rising levels of overall debt and repayments will become unsustainable for customers. From our consumer research, we are concerned that firms are lending to customers beyond levels which they can sensibly manage and causing customer harm as a result. Notably:

| 48% of customers told us that they had to cut back on other spending to make their loan repayments |

| 37% told us they had missed payments on their rent, mortgage, utility bills or council tax in the last 6 months, to ensure they could make repayments on their relending |

| 16% of customers reported their most recent relending was taken to repay debt with other firms |

| 45% of customers told us they regretted taking out additional lending |

| 45% of customers said they had experienced anxiety and stress in the previous few weeks because of financial difficulties |

We are particularly concerned to see behaviour which suggests some customers may be managing financial difficulties through further borrowing. We consider that additional borrowing should not be used, in effect, as a debt management solution. When considering an application for refinancing where the firm is aware that the customer is a regular user and appears dependant on high-cost credit we expect the firm to assess the customer’s best interests. They do this by considering the customer’s overall financial situation and whether forbearance or debt advice might be more appropriate than additional lending.

We are also concerned to see some firms not taking their responsibilities to assess affordability for repeat borrowers as seriously as we would expect. For example, rather than gather up-to-date customer information, some firms ask customers to confirm there have been no changes in their financial circumstances since the last affordability check was completed and some online applications pre-fill answers with the last details given. While we recognise that firms may want to streamline and automate their processes, they must base every lending decision on up-to-date and accurate information.

There has been some debate in the HCSTC market about how our creditworthiness rules should apply to repeat lending.

Other than for rollovers, our rules do not expressly prevent firms from issuing more than a particular number of loans to a customer. However, firms do still need to comply with our creditworthiness rules in doing so, including assessing the affordability risk to the borrower. This is a view shared by the Financial Ombudsman Service.

Relending, profitability and consumer harm

Relending accounts for a high proportion of business and drives profitability in many firms, which gives rise to customer harm

In addition to examining customer loan histories, we also reviewed a sample of firms’ loan books to understand the proportion of and growth in relending over a 3-year period.

We identified that most firms had more repeat than first-time borrowers and repeat borrowers accounted for more than 80% of all customers at many firms. We recognise there are additional financial costs of acquiring new customers and acknowledge there are commercial reasons for lending to existing customers rather than expanding the customer base. However, we remind firms of their requirement to lend responsibly and to be mindful that driving profitability through repeat lending has the potential to lead to poor customer outcomes if not properly managed.

Having looked at customer lending journeys we are concerned that some customers may be suffering harm because of over indebtedness and we expect firms to review their lending practices and operations to ensure they are appropriately discharging their obligations to lend responsibly.

Marketing activity and customer behaviour

Firms’ marketing activity can adversely influence customer behaviour, when we think customers should be in control of their borrowing decisions

We recognise the tension between maintaining brand and product awareness and straying into behaviour which may adversely influence customer decision making. However, we expect to see marketing strategies and operations which put customers in control of their decisions to apply for additional borrowing when it is in their best interest, without adverse influence from firms.

We expect to see marketing content which contains all relevant information and is sufficient to support customers, so they can make informed decisions about whether to apply for additional borrowing. We do not think firms should encourage relending where the firm knows, or has reason to believe, that the agreement would be unsuitable for that customer in the light of their financial circumstances or any other relevant matters that the firm is aware of. We do not think all firms currently achieve these objectives and expect them to do more in this space.

We looked at how firms marketed and promoted further credit to existing customers, including reviewing the content and frequency of firms’ messages and how firms promote relending online.

We saw across the sample that firms’ marketing objective is to maintain customer awareness of potentially available credit. Firms most commonly use electronic channels (text messages and emails) to convey this message.

We think the marketing is persistent; firms tend to send marketing communications on average around 5 times per quarter to customers. Except for some outlier firms, we did not generally find the number of communications excessive.

Marketing materials

Marketing materials need to be more balanced for customers to be able to make more informed decisions

To be clear, fair and not misleading, we think customers would benefit from prompts to enable them to fully understand the proposition they are entering into, and to stop and think about whether applying for further borrowing is right for them. We expect firms to take action to ensure marketing material is more balanced. We expect firms to consider whether their marketing is omitting information which would be important for their customers.

We reviewed a sample of marketing content from all firms. We found it generally focuses on the ease, convenience and benefits of taking more credit, but lacks balance as it fails to present a fair and prominent indication of relevant risks.

Some harms associated with further borrowing:

- Customers cannot afford to repay. While firms must make a reasonable assessment that credit is affordable when the customer applies, marketing material does not prompt a customer to think about how they will manage repayments, particularly if their circumstances change. Given the circumstances of high-cost credit users, this could be seen as an omission of important information during the term of the loan.

- Customers take additional borrowing to mask already deteriorating financial circumstances – we are particularly concerned to see the high levels of regret of taking additional borrowing. On average, 45% of customers regretted their decision to borrow more money and for some products this rose to over 60%.

- Customers also reported borrowing more to pay off other debts. While debt consolidation may benefit customers, marketing material does not prompt them to consider whether using additional borrowing leads to postponement of repaying existing debt and incurring significantly more interest cost.

- Customers do not always know the total amount of their debt to the lender (and the overall cost of borrowing), because the information they get gives prominence to the additional lending only, rather than the total amount borrowed.

Marketing materials should not exploit customer bias to adversely influence customer behaviour and cause harm

We have seen a range of behavioural responses which firms’ communications can prompt. We expect to see customers in this sector driving their own decisions about additional borrowing. We also expect firms to review their communications with customers and make any necessary amendments to ensure they are fair, informative and balanced in the context of their customer base. This could also help firms ensure they are not refinancing against the customer’s best interests and that they are only relending at the customer’s request or with the customer’s consent.

In their marketing material, some firms appear to appeal to social norms to convey a message that relending is common practice and ‘normal’ behaviour. For instance, some firms’ communications used phrases such as ‘enabled us to help thousands of customers’ and ‘being there when our customers need us the most’.

Relending is common place (indeed, consumers tell us that they see credit as a part of everyday life). However, we ask firms to remember the more vulnerable and financially stretched nature of the high-cost customer base. They should be mindful that such messages could be interpreted as tacit endorsement of a customer taking further credit – the ‘if it’s okay for everyone else to take further borrowing then it must be okay for me’ type scenario.

We also saw some evidence of firms suggesting how customers could use additional borrowing, for example, taking a holiday and reinforcing the message by including imagery of exotic locations. There is a danger that some customers could be susceptible to suggestive marketing behaviour that could adversely impact their decision making around reborrowing. For those customers who are vulnerable or financially stretched, the impact of adverse influence could lead to harm.

We saw many firms encourage customers to borrow more by stating the upper limit of what they could borrow. For example, emails and texts told customers ‘you can get a loan of up to £1,000’. Such advertising exploits the cognitive bias known as ‘anchoring’, where consumer decision making can be unduly influenced by the initial information they receive. In addition, where online applications are used, we have seen firms automatically setting the default application amount and repayment term above the minimum offered.

Such communications could (even unwittingly) influence a customer’s decision making about how much to borrow. In our consumer research, customers told us they sometimes took higher value loans than they had originally planned.

Firms should therefore remember that communications which use anchoring or online applications which use ‘defaults’ could unduly influence customers to take more money than intended. Where customers are vulnerable or financially stretched, this could lead to harm.

The speed and ease of applications is promoted by nearly all firms and some customers tell us that they value it. Some commented on the speed and convenience of the approval process. But some went on to regret their decision to take additional lending; on average 48% of customers in our research told us they regretted taking additional borrowing. Firms should therefore be mindful that promoting speed and ease could inadvertently prompt rash decision making by customers.

Alan took out the original (HCPL) loan in 2017 to consolidate his debts. He has topped up 5 times and found applying to top up very convenient and easy.

As a result of his most recent top up, he felt that the cost of reborrowing has become too much and is now a stress and a burden. He felt an element of shame towards borrowing. Alan regrets his most recent loan and would try to get the money from elsewhere, eg boot sales or a second job if he were in the same situation again.

Consumer Research

It takes me about 5 minutes to apply, there’s no difficult questions and it’s a hidden process as well. I went online, did the affordability check and got approved straight away; this has always been my experience.

Male, 40 , Birmingham

Marketing materials should not mislead customers

We expect firms to ensure their marketing material is clear, fair and not misleading and we are concerned to see the use of misleading time limited offers. We ask firms to review their marketing materials and make any necessary amendments to ensure they are not misleading.

Some firms include wording designed to make customers believe the offer of additional credit is time critical (for example, use of words such as ‘Act fast – this is a time limited offer’). However, firms told us these offers were not time critical which would mean those promotions were misleading. Customers need enough time to consider whether to seek additional borrowing and work out if it would be their own best interests. They must not feel pressured into doing so.

Marketing materials must comply with financial promotion rules

In addition to the broader concerns with firms’ financial promotions to existing customers, a small number of firms were failing to meet some specific requirements for financial promotions as set out in CONC 3. We expect firms to pay due care and attention to the design of their financial promotions and are concerned to see breaches in particular around pre-approvals. Firms should review and if necessary amend their marketing content to ensure it meets our financial promotion rules focusing particularly on the following issues:

- Pre-approvals – a small number of firms issued marketing communications informing customers they had been pre-approved for a certain level of further credit.

- We saw some firms make the daily interest rate, which is significantly lower, more prominent in their marketing materials than the representative APR. This could mislead customers.

- Failure to include the HCSTC risk warning – a small number of HCSTC firms failed to add the following risk warning to their marketing communications as required by our rules: ‘Warning: Late repayment can cause you serious money problems. For help, go to moneyadviceservice.org.uk’

Online account messages

Online account messages encouraging customer to reborrow could constitute marketing and must not restrict access to customer accounts

We have serious concerns around some of the ways online accounts are being used to offer additional credit to customers and we expect firms to take swift action to assess their operations and take any necessary remedial action.

Many firms provide customers with online accounts (including via apps) to manage their borrowing. Firms also use these accounts as a vehicle to offer additional credit to existing borrowers, for example via pop-up type messages or areas within the account which customers can access to apply for further credit.

Some firms do not consider that online account activity to offer additional credit to customers constitutes marketing. We disagree. Any communication offering additional credit to a customer constitutes marketing and is subject to both our requirements on financial promotions as well as data protection laws around privacy. Firms need to review their online communications operations, including who receives online messages, and make any necessary amendments to ensure they comply with FCA requirements and privacy laws.

In addition, we have seen some online accounts where each time a customer logs into their account a message offers them additional credit and requires them to actively accept or reject the offer by clicking the relevant button (with the accept button being far more prominent than the reject one). The customer cannot proceed to access their account without making this decision. We have serious concerns about this practice because:

- It is not appropriate to deny access to the content of a customer’s account until they have decided whether to take up an offer of further borrowing.

- Messages appear every time a customer logs in to their account. Depending upon the frequency of customer log-in, there is a danger that this sort of marketing could become excessive and that firms are unable to control how this type of marketing fits in with other campaigns.

- Messages appear at customer log-in irrespective of the customer’s preferences. We expect firms to only issue marketing materials to customers in compliance with their obligations under the Privacy and Electronic Communications Regulations and/or the GDPR and to have regard to any relevant guidance from the Information Commissioner’s Office.

- The content of the messages had many of the shortcomings outlined for other forms of marketing set out in this report.

Refinancing loans

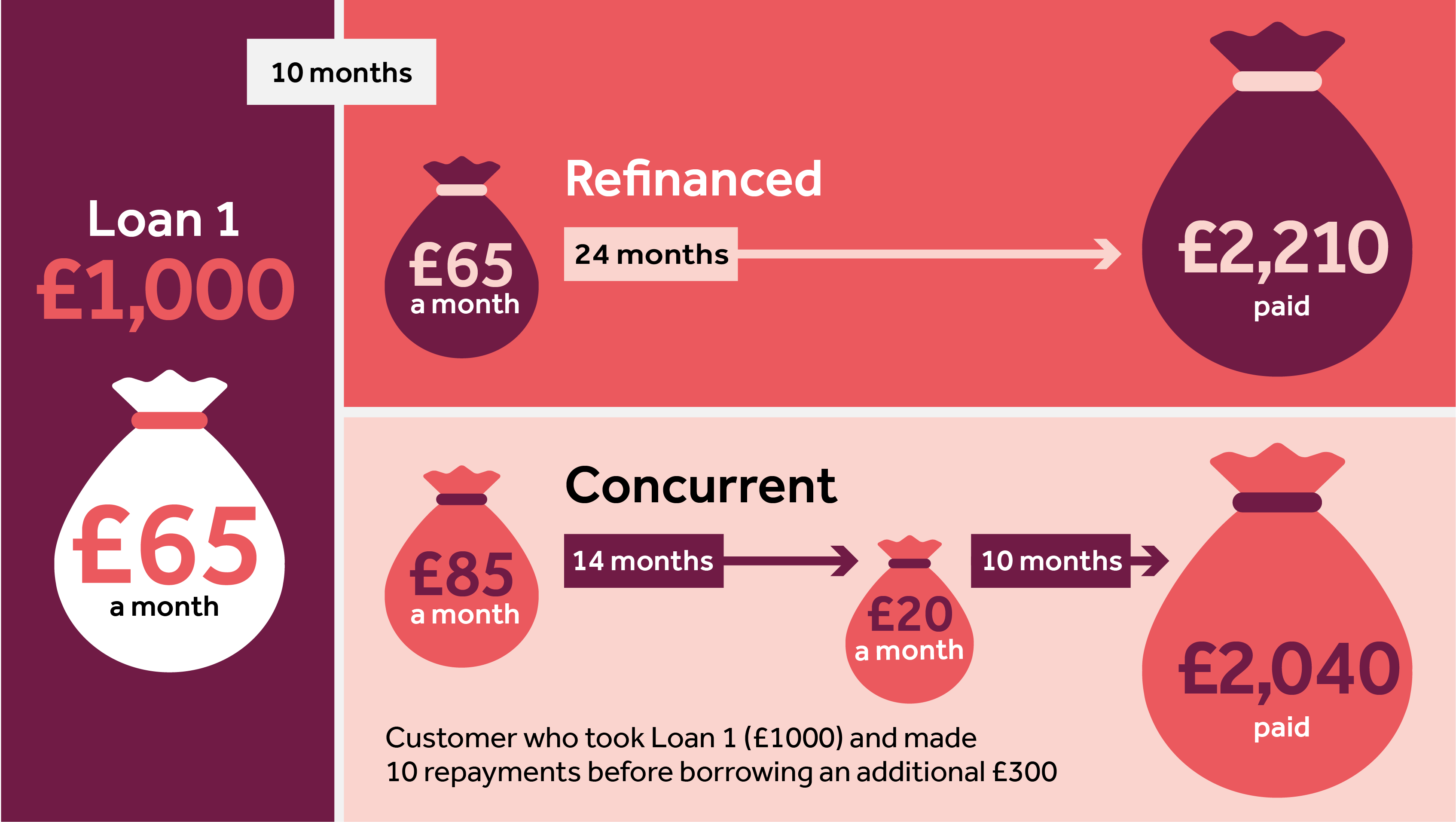

Refinancing is more expensive overall than concurrent lending and customers should be able to make informed borrowing decisions

There are a number of different ways in which a customer can take additional borrowing and our analysis has considered 2 ways (refinancing and concurrent loans) where the total amount of interest paid and the instalment amounts are different for each. So it is important that customers can make informed decisions about which relending option to take where these are available. We are concerned that customers do not always have the relevant information to do so.

Home-collected credit firms must explain the different relending options and associated costs to customers before they take additional borrowing. We think firms that offer customers other products should do more to ensure customers are treated fairly and have adequate information, even in the absence of a specific requirement as for home-collected credit firms. This is particularly important given the more vulnerable and financially stretched customer base where even small changes in costs can have a significant impact.

The 2 types of relending where costs differ are:

- Refinancing (also referred to as top-up loans, rollovers, renewals). This is where the balance of an existing loan is added to and subsumed into a new loan and the existing loan is closed.

- Concurrent loan (also referred to as a parallel loan). This is where a customer takes a new loan and both the existing and new loan continue at the same time, but they may end on different dates.

There are key differences between refinancing and taking concurrent loans as set out in table 1.

Table 1: Key facts when relending: refinancing versus concurrent loans

| Refinancing | Concurrent lending | |

|---|---|---|

| Repayment term |

The term of original loan is extended and 2 loans are combined. |

The term and payments of the original loan stays the same. The term and payments of the new loan may be the same or different to the original loan. |

| Interest paid (assuming the interest rate stays the same) and total cost to customer | Customers pay more interest overall than under 2 concurrent loans because the term of the loan is extended and additional interest is charged on the original borrowing. This means the total cost is higher than for 2 concurrent loans. | Customers pay less interest overall than for refinanced loans. The total cost is less than if they had refinanced. |

| Instalment payments | There is only 1 loan instalment payment which is lower than 2 concurrent loans at first. | There are 2 loan instalment payments and the total of these is higher than the payment for a refinanced loan at first. Once the first loan has been repaid, the remaining instalment on the new loan will be lower than the refinanced loan payment. |

| Time to repay the borrowing | In most cases the loan will take longer to repay than with 2 concurrent loans. | In most cases the loans will be repaid quicker than a refinanced loan. |

| Early settlement charges | Some lenders make an early settlement charge, even though the original loan is being refinanced not settled. This charge is added to the balance of the refinanced loan and interest charged on it. These charges can compound if a loan is refinanced on multiple occasions. | Because the original loan continues, an early settlement charge is not applied at the time a customer takes additional credit. |

| Cash in hand | Customers will receive a lower amount of cash in hand than that borrowed because some of the additional credit is used to repay the original loan. | Customers receive the full value of the new loan as cash in hand. |

Figure 3: Infographic detailing the cost difference between refinancing and concurrent loans

Early settlement charges

Early settlement charges should not be charged when a customer refinances their loan

We found that where customers refinance, some firms make an early settlement charge. Such charges include an element intended to compensate a firm where the loan is settled early as well as additional interest accruing up to the settlement date.

There are 2 main elements to an early settlement charge which can result in customers being charged a sum up to the value of 58 days interest. These are set out in the Consumer Credit (Early Settlement) Regulations 2004 (the 2004 Regulations) and broadly are as follows:

- Customers exercising their rights to settle early – where a customer gives notice to a firm that they wish to settle their loan early a firm can calculate the amount due at a date 28 days after the date of receipt of such a notice (or 13 days interest for home-collected credit firms).

- Loans lasting over 12 months – for credit agreements lasting longer than 12 months firms can charge an additional 30 days interest (technically, the settlement date for calculation of the rebate is deferred by 30 days). Home-collected credit firms are not able to include this element, even for agreements which last longer than 12 months.

When firms make an early settlement charge as part of a refinancing, the charge is added to the new loan and so interest is charged on this charge. If the credit is refinanced several times then the costs compound.

We believe some firms require or encourage a customer to serve notice that they wish to settle their existing loan early when they are refinancing their existing debt. If the customer does not give notice, then there is no ability to recover 28 days interest under the 2004 Regulations. Customers do not need to give notice that they wish to settle their existing loan early when refinancing. Firms should not seek to exploit these regulations by insisting that the customer gives notice if not necessary.

Charging this element of the early settlement fee is widespread in the home-collected credit sub-sector (albeit these firms charge a reduced fee equal to 13 days interest) and a small number of other firms from our sample.

We expect firms to stop requiring or encouraging the borrower to serve the statutory notice when refinancing immediately. This will remove the ability of firms to charge the 28/13-day element of the early settlement charge.

In respect of the 30-day charge for loans lasting over 12 months, we recognise that this is provided for in the 2004 Regulations. However, it is unlikely that the lender incurs the same costs (if any) on a refinance compared to the first loan. So we would ask firms to consider if whether applying this charge is appropriate on a refinancing. We have seen several instances of this charge being made on frequent refinancing with the same customer and which may lead to over-recovery.

We therefore ask firms who apply this charge to consider its appropriateness when refinancing.

Consumer report by PWC

We commissioned this study by PWC to help us understand repeat borrowing in the high-cost credit market.

We wanted to establish the reasons for repeat borrowing, whether consumers' decisions to re-borrow were being driven more by themselves or by lender activity such as marketing, and whether consumers were being harmed by re-borrowing.

Rules

This annex to our multi-firm review sets out the relevant Handbook rules and guidance, as well as relevant statutory provisions and should be read in conjunction with the multi-firm review.